TurboTax Question

Apr 3, 2023 10:26:28 #

BebuLamar wrote:

No TT tax asked you a lot of question on their own forms. The official IRS form can only be seen when you save or print the pdf that they created. I used TT for more than 10 years now. I use it for 2 reasons.

1. Online filing.

2. My wife does a lot of stock trading and it's a pain to enter the transaction manually. TT can import the documents from the broker and fill it in automatically.

Otherwise my tax is quite simple and I would simply download the form from the IRS and file.

1. Online filing.

2. My wife does a lot of stock trading and it's a pain to enter the transaction manually. TT can import the documents from the broker and fill it in automatically.

Otherwise my tax is quite simple and I would simply download the form from the IRS and file.

I use H&R Block for the same reason. We can’t (thankfully) itemize so the vast majority of the couple hours it takes to file are verifying individual broker transactions after the download from Fidelity.

Apr 3, 2023 10:26:37 #

marine73 wrote:

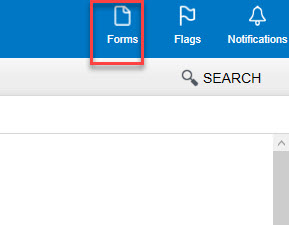

At the top there is a tab called forms and several... (show quote)

These fees as well as the cost if the softwear, that you paid this year, ARE deductable when you file your 2023 return(s). You can also deduct on your 2022 return the costs you incurred last year to prepare & file your 2021 return. And, you can file amended returns for a few years to recoup the taxes you paid on the money you spent to file those previous years' returns. However, the money you do receive may not pay for the time you spend preparing all those amended returns. But you will make the IRS work a bit more to process them. YMMV, of course. Good luck

Apr 3, 2023 10:32:16 #

marine73 wrote:

At the top there is a tab called forms and several... (show quote)

I didn't have the tabs on my TT. I filed the Fed for free, but I had to pay for the State. NY requires e-filing, so everyone has to pay, I guess.

Apr 3, 2023 10:55:14 #

jerryc41 wrote:

I used TT this year, but I wasn't able to look at the actual tax forms. Is this possible before saving and printing? I paid already.

You may initiate a Chat or Call back. I have used it often and find their support excellent.

Why not ask them?

Mark

Apr 3, 2023 12:09:19 #

markngolf wrote:

You may initiate a Chat or Call back. I have used it often and find their support excellent.

Why not ask them?

Mark

Why not ask them?

Mark

I tried to start a Chat, but I didn't get far with it. I forget the details. Most Chats begin with a "robot" who is never any help.

Apr 3, 2023 12:19:56 #

jerryc41 wrote:

I tried to start a Chat, but I didn't get far with it. I forget the details. Most Chats begin with a "robot" who is never any help.

It does not take very long to complete the "robot" and get to a live support person. I've been using Turbo Tax for 12+ years and have had many "Chats".

Mark

Apr 3, 2023 13:19:27 #

jerryc41 wrote:

I tried to start a Chat, but I didn't get far with it. I forget the details. Most Chats begin with a "robot" who is never any help.

open the chat & answer the 'robot's' question with "speak to an agent" - worked for me, just now with HRBlock. YMMV, of course. good luck

Apr 3, 2023 13:34:27 #

jerryc41 wrote:

I used TT this year, but I wasn't able to look at the actual tax forms. Is this possible before saving and printing? I paid already.

On the upper right of the screen you can change to "Forms View"

Apr 3, 2023 13:48:34 #

I use TT every year. After I have finished filing I download a PDF of all of the forms involved.

I just logged into TT and the download link is on the first page about my return.

Good luck.

Ed

I just logged into TT and the download link is on the first page about my return.

Good luck.

Ed

Apr 3, 2023 14:08:05 #

SunBeach1962

Loc: Syrscuse, NY

jerryc41 wrote:

I used TT this year, but I wasn't able to look at the actual tax forms. Is this possible before saving and printing? I paid already.

You can change from the interview mode to the form's view when using TT

Apr 3, 2023 14:34:30 #

jerryc41 wrote:

I used TT this year, but I wasn't able to look at the actual tax forms. Is this possible before saving and printing? I paid already.

Upper right is a tab to select a form.

Apr 3, 2023 17:42:28 #

Enrico Verdi

Loc: Sand Brook, NJ

If you're fortunate enough to be over 65, Turbo tax will open a saved pdf from the prior tax year but it will NOT

populate all the fields on the forms and worksheets. It doesn't "read" the 1040-SR that is generated for the pdf.

The 1040-SR is automatically generated according to birth date.

Always save your current years work in the native TT "*.tax2022" as generated for whatever year your working on. .

The data will magically appear the following year to give a running year to year line by line comparison. (provided you do not change or modify you desktop comp! ie format, change C drive etc)

If you use the online version of TT, the file is saved online with your account but you can still save a PDF for use on your computer.

I learned this the hard way.....

populate all the fields on the forms and worksheets. It doesn't "read" the 1040-SR that is generated for the pdf.

The 1040-SR is automatically generated according to birth date.

Always save your current years work in the native TT "*.tax2022" as generated for whatever year your working on. .

The data will magically appear the following year to give a running year to year line by line comparison. (provided you do not change or modify you desktop comp! ie format, change C drive etc)

If you use the online version of TT, the file is saved online with your account but you can still save a PDF for use on your computer.

I learned this the hard way.....

Apr 3, 2023 17:51:22 #

Apr 3, 2023 18:50:29 #

Cbrummer

Loc: Lower Michigan

In a purchased TT product, whether downloaded or installed from a cd, there are tabs along the top as well as a forms icon. Depending upon which version you are using, you should be able to view “step-by-step” which is TT default. Another choice is “forms.” Information may be entered in either of these views.

The on-line version is more limited.

This should work:

To preview your 1040:

Sign in to TurboTax Online.

Next, click the Take me to my return button

Click Tax Tools from the black menu to the left

Then, select Tools

To see the Tools option here, you must have moved past the orange "Take me to my return" button and you must be using a web browser (the mobile app will not show you the Tools feature)

In the black menu to the left, click on Preview my 1040 to view your form.

That may seem convoluted. However, it is possible to save work to-date and ask to print in most cases.

The only caveat is that TT will sometimes create its own version of IRS sub-worksheets such as are mentioned in the instructions for Form 1040.

The on-line version is more limited.

This should work:

To preview your 1040:

Sign in to TurboTax Online.

Next, click the Take me to my return button

Click Tax Tools from the black menu to the left

Then, select Tools

To see the Tools option here, you must have moved past the orange "Take me to my return" button and you must be using a web browser (the mobile app will not show you the Tools feature)

In the black menu to the left, click on Preview my 1040 to view your form.

That may seem convoluted. However, it is possible to save work to-date and ask to print in most cases.

The only caveat is that TT will sometimes create its own version of IRS sub-worksheets such as are mentioned in the instructions for Form 1040.

Apr 3, 2023 21:20:39 #

I’m pretty sure in the past I’ve been able to see the forms before completing and printing. But, I really wasn’t interested enough to do much checking and certainly wouldn’t swear I did see them. To me the whole mess is just something to get through every year and TT works great for me. Been using it at least 20 years. Back when life was simpler and I did ours by hand I actually knew what I was doing, or thought I did. Now, I just fill in the blanks TT asks for, let it check for mistakes, correct those, and send ‘er off. And be glad it’s over for another year.

Ron

Ron

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.