Posts for: WNYShooter

Apr 24, 2023 11:14:58 #

https://nypost.com/2023/04/23/h****r-biden-may-be-living-at-the-white-house-to-evade-legal-papers-from-his-baby-mama/

H****r B***n is believed to be hiding out at the White House while his baby mama goes on the warpath.

Lawyers for former stripper Lunden Roberts asked an Arkansas court Friday to jail the first son for failing to fork over his financial records as required in her lawsuit over support payments for their 4-year-old unacknowledged daughter, Navy.

Roberts claims H****r, 53, is “flaunting the dignity and authority of the court” by failing to provide “one single item or word [of] discovery” and says, “This court should incarcerate the defendant in the Cleburne County Detention Center until he complies with this court’s orders.”

Roberts, 32, had to get a court-ordered paternity test to prove Navy was H****r’s, and last year H****r applied to have his monthly support payments reduced.

She also has enlisted Biden nemesis Garrett Ziegler as an expert witness for the trial expected in July.

The 27-year-old former Trump adviser is founder of the nonprofit Marco Polo, which published a 644-page analysis of H****r’s infamous laptop last year, identifying hundreds of alleged crimes.

Tracking the first son

Ziegler is being sued by H****r’s “sugar brother,” wealthy Hollywood lawyer Kevin Morris, for alleged harassment and invasion of privacy.

Morris generously paid off H****r’s $2.8 million IRS bill, which is part of a federal criminal investigation by the US attorney in Delaware, David Weiss, into the first son’s overseas business dealings.

Things were brought to a head last week when a career IRS criminal supervisory special agent who has been investigating H****r for three years came forward with claims that federal prosecutors are preventing tax charges from being brought against the president’s son.

“Preferential treatment and politics [are] improperly infecting decisions” in the case, the whistleblower’s attorney, Mark Lytle, alleged in a letter to Democrats and Republicans leading various congressional committees.

Roberts’ legal maneuvers in Arkansas lend weight to the rumor in Washington, DC, that H****r has been living at the White House with his second wife, Melissa Cohen, and their 3-year-old son, Beau, allegedly to avoid being served with legal papers.

Numerous sightings over the past six months lend credence to the idea, with H****r and his family spotted trailing his father and the first lady onto Marine One for weekends away to Delaware or Camp David, or for longer vacations at the borrowed homes of billionaires.

Last week H****r joined his father on a state visit to Ireland.

Surrounded by his father’s Secret Service detail and protected by his own agents, it is difficult for a process server to get to him.

From early last year, an elaborate swing set suitable for a toddler was spotted on the White House grounds when the president ambled back to his office from Marine One.

There also may be other Biden family members shacked up in the White House on the taxpayer dime.

The New York Times reported in November, when Naomi Biden, 28, H****r’s eldest daughter with ex-wife Kathleen Buhle, and husband Peter Neal were married on the South Lawn, that the couple “live at the White House, according to two people familiar with their living situation.”

The Executive Residence of the White House has 16 guest bedrooms and 35 bathrooms on the second and third floors, as well as a private guest kitchen. The family also can avail themselves of an in-house gym, bowling alley and private cinema.

There is plenty of room for the entire Biden clan, including the 12 immediate family members claimed by House Oversight Committee Chairman James Comer (R-Ky.) this week to be profiting from foreign influence peddling.

‘This is bad’

Having perused hundreds of new financial documents, Comer on Sunday said there may be another three family members on top of the nine he identified last week, including H****r, uncle Jim Biden and sister-in-law and former lover Hallie Biden.

“I haven’t found any legitimate business dealings on the Biden end [unless you count] influence peddling,” Comer told Fox News’ Maria Bartiromo.

“If you want to get to a legal term, that’s called being a foreign agent. They weren’t registered as a foreign agent and I’m sure the ethics laws would prevent immediate family members of high-ranking government officials from being foreign agents,” he said. “Either way this is bad. There are more laws that appear to me that have been broken than just tax evasion and there are a lot more Bidens involved than just the president’s son and his brother.”

H****r’s lawyers reportedly are scheduled to meet Delaware US Attorney Weiss next week over potential charges in the five-year criminal investigation into his foreign business dealings.

Comer says the DOJ is “in a pickle here especially now with the IRS whistleblower.”

“There’s no rhyme or reason why H****r B***n shouldn’t have been indicted years ago … but one of the challenges [for the DOJ is] what do you do with this many family members of the president? There’s not going to be anybody left for a Christmas picture if the DOJ did their job and went and indicted anyone who has any type of fingerprints involved in this influence-peddling scheme,” Comer noted. “I mean, it’s the entire family.”

Comer also foreshadowed an upcoming press conference on “six specific decisions Joe Biden made either as vice president or president that are very concerning to us that we believe could potentially lead back to payments that were … laundered down to the Biden family members.”

He added, “There’s no … explanation for this family to receive this many suspicious wires from our adversaries around the world if Joe Biden weren’t directly involved in some type of decision making, because I am confident that these people who were wiring the Bidens were expecting to get a return on their investment and there isn’t a single one of those family members that had the ability to do anything to influence foreign policy other than the ‘Big Guy’ Joe Biden.”

‘C*********d’?

Comer saved his harshest words for the president over perceived soft treatment of China.

“China continues to steal our intellectual property. They continue to manipulate our currency. They continue to buy companies around the world that are a problem from a national security standpoint and yet this president does nothing about China,” he said. “It makes you wonder if he is, in fact, c*********d because of the millions of dollars his family has already taken in from the Chinese C*******t Party.”

While Dems and enabling media continue to disparage the past week’s bombshell revelations, as Comer says, “the walls are closing in on the Biden family,” even if those walls are in the heavily guarded White House.

H****r B***n is believed to be hiding out at the White House while his baby mama goes on the warpath.

Lawyers for former stripper Lunden Roberts asked an Arkansas court Friday to jail the first son for failing to fork over his financial records as required in her lawsuit over support payments for their 4-year-old unacknowledged daughter, Navy.

Roberts claims H****r, 53, is “flaunting the dignity and authority of the court” by failing to provide “one single item or word [of] discovery” and says, “This court should incarcerate the defendant in the Cleburne County Detention Center until he complies with this court’s orders.”

Roberts, 32, had to get a court-ordered paternity test to prove Navy was H****r’s, and last year H****r applied to have his monthly support payments reduced.

She also has enlisted Biden nemesis Garrett Ziegler as an expert witness for the trial expected in July.

The 27-year-old former Trump adviser is founder of the nonprofit Marco Polo, which published a 644-page analysis of H****r’s infamous laptop last year, identifying hundreds of alleged crimes.

Tracking the first son

Ziegler is being sued by H****r’s “sugar brother,” wealthy Hollywood lawyer Kevin Morris, for alleged harassment and invasion of privacy.

Morris generously paid off H****r’s $2.8 million IRS bill, which is part of a federal criminal investigation by the US attorney in Delaware, David Weiss, into the first son’s overseas business dealings.

Things were brought to a head last week when a career IRS criminal supervisory special agent who has been investigating H****r for three years came forward with claims that federal prosecutors are preventing tax charges from being brought against the president’s son.

“Preferential treatment and politics [are] improperly infecting decisions” in the case, the whistleblower’s attorney, Mark Lytle, alleged in a letter to Democrats and Republicans leading various congressional committees.

Roberts’ legal maneuvers in Arkansas lend weight to the rumor in Washington, DC, that H****r has been living at the White House with his second wife, Melissa Cohen, and their 3-year-old son, Beau, allegedly to avoid being served with legal papers.

Numerous sightings over the past six months lend credence to the idea, with H****r and his family spotted trailing his father and the first lady onto Marine One for weekends away to Delaware or Camp David, or for longer vacations at the borrowed homes of billionaires.

Last week H****r joined his father on a state visit to Ireland.

Surrounded by his father’s Secret Service detail and protected by his own agents, it is difficult for a process server to get to him.

From early last year, an elaborate swing set suitable for a toddler was spotted on the White House grounds when the president ambled back to his office from Marine One.

There also may be other Biden family members shacked up in the White House on the taxpayer dime.

The New York Times reported in November, when Naomi Biden, 28, H****r’s eldest daughter with ex-wife Kathleen Buhle, and husband Peter Neal were married on the South Lawn, that the couple “live at the White House, according to two people familiar with their living situation.”

The Executive Residence of the White House has 16 guest bedrooms and 35 bathrooms on the second and third floors, as well as a private guest kitchen. The family also can avail themselves of an in-house gym, bowling alley and private cinema.

There is plenty of room for the entire Biden clan, including the 12 immediate family members claimed by House Oversight Committee Chairman James Comer (R-Ky.) this week to be profiting from foreign influence peddling.

‘This is bad’

Having perused hundreds of new financial documents, Comer on Sunday said there may be another three family members on top of the nine he identified last week, including H****r, uncle Jim Biden and sister-in-law and former lover Hallie Biden.

“I haven’t found any legitimate business dealings on the Biden end [unless you count] influence peddling,” Comer told Fox News’ Maria Bartiromo.

“If you want to get to a legal term, that’s called being a foreign agent. They weren’t registered as a foreign agent and I’m sure the ethics laws would prevent immediate family members of high-ranking government officials from being foreign agents,” he said. “Either way this is bad. There are more laws that appear to me that have been broken than just tax evasion and there are a lot more Bidens involved than just the president’s son and his brother.”

H****r’s lawyers reportedly are scheduled to meet Delaware US Attorney Weiss next week over potential charges in the five-year criminal investigation into his foreign business dealings.

Comer says the DOJ is “in a pickle here especially now with the IRS whistleblower.”

“There’s no rhyme or reason why H****r B***n shouldn’t have been indicted years ago … but one of the challenges [for the DOJ is] what do you do with this many family members of the president? There’s not going to be anybody left for a Christmas picture if the DOJ did their job and went and indicted anyone who has any type of fingerprints involved in this influence-peddling scheme,” Comer noted. “I mean, it’s the entire family.”

Comer also foreshadowed an upcoming press conference on “six specific decisions Joe Biden made either as vice president or president that are very concerning to us that we believe could potentially lead back to payments that were … laundered down to the Biden family members.”

He added, “There’s no … explanation for this family to receive this many suspicious wires from our adversaries around the world if Joe Biden weren’t directly involved in some type of decision making, because I am confident that these people who were wiring the Bidens were expecting to get a return on their investment and there isn’t a single one of those family members that had the ability to do anything to influence foreign policy other than the ‘Big Guy’ Joe Biden.”

‘C*********d’?

Comer saved his harshest words for the president over perceived soft treatment of China.

“China continues to steal our intellectual property. They continue to manipulate our currency. They continue to buy companies around the world that are a problem from a national security standpoint and yet this president does nothing about China,” he said. “It makes you wonder if he is, in fact, c*********d because of the millions of dollars his family has already taken in from the Chinese C*******t Party.”

While Dems and enabling media continue to disparage the past week’s bombshell revelations, as Comer says, “the walls are closing in on the Biden family,” even if those walls are in the heavily guarded White House.

Apr 23, 2023 17:14:29 #

dlwhawaii wrote:

I'm lazy? You're the lackadaisical clown who made the original post who's too slothful to post your source. It's not my fault you can't find a source. You're wrong. BS. What's your source, if any? Middle class has NOTHING to do with median price. crickets. LOL. MGYS.

Instead of letting you froth at the mouth and flail your arms in despair any further due to you lack of research abilities and general intelligence deficit, I will help you out a little. I'll try to keep it really simple and within you comprehension abilities.

"The middle class, once the economic stratum of a clear majority of American adults, has steadily contracted in the past five decades. The share of adults who live in middle-class households fell from 61% in 1971 to 50% in 2021, according to a new Pew Research Center analysis of government data."

https://www.pewresearch.org/short-reads/2022/04/20/how-the-american-middle-class-has-changed-in-the-past-five-decades/

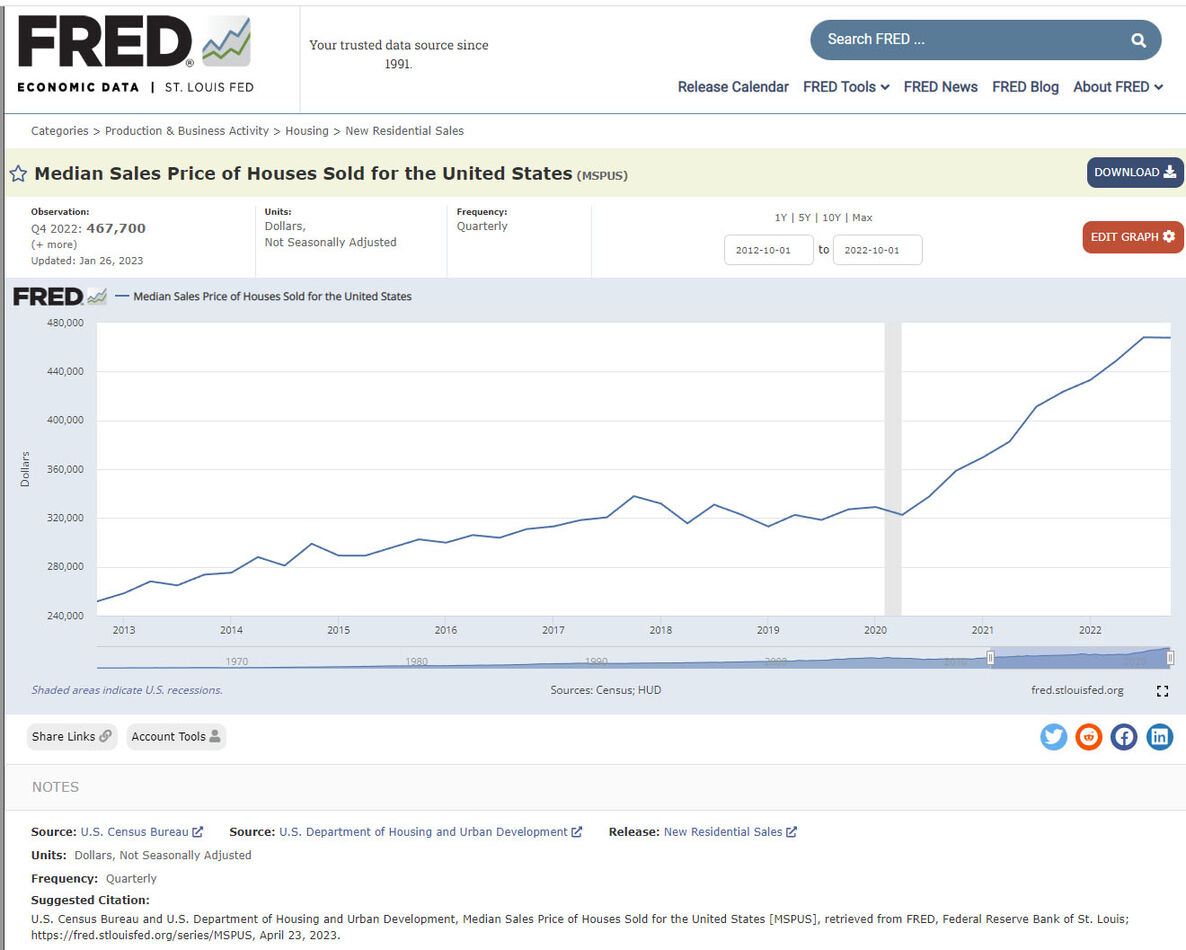

https://fred.stlouisfed.org/series/MSPUS

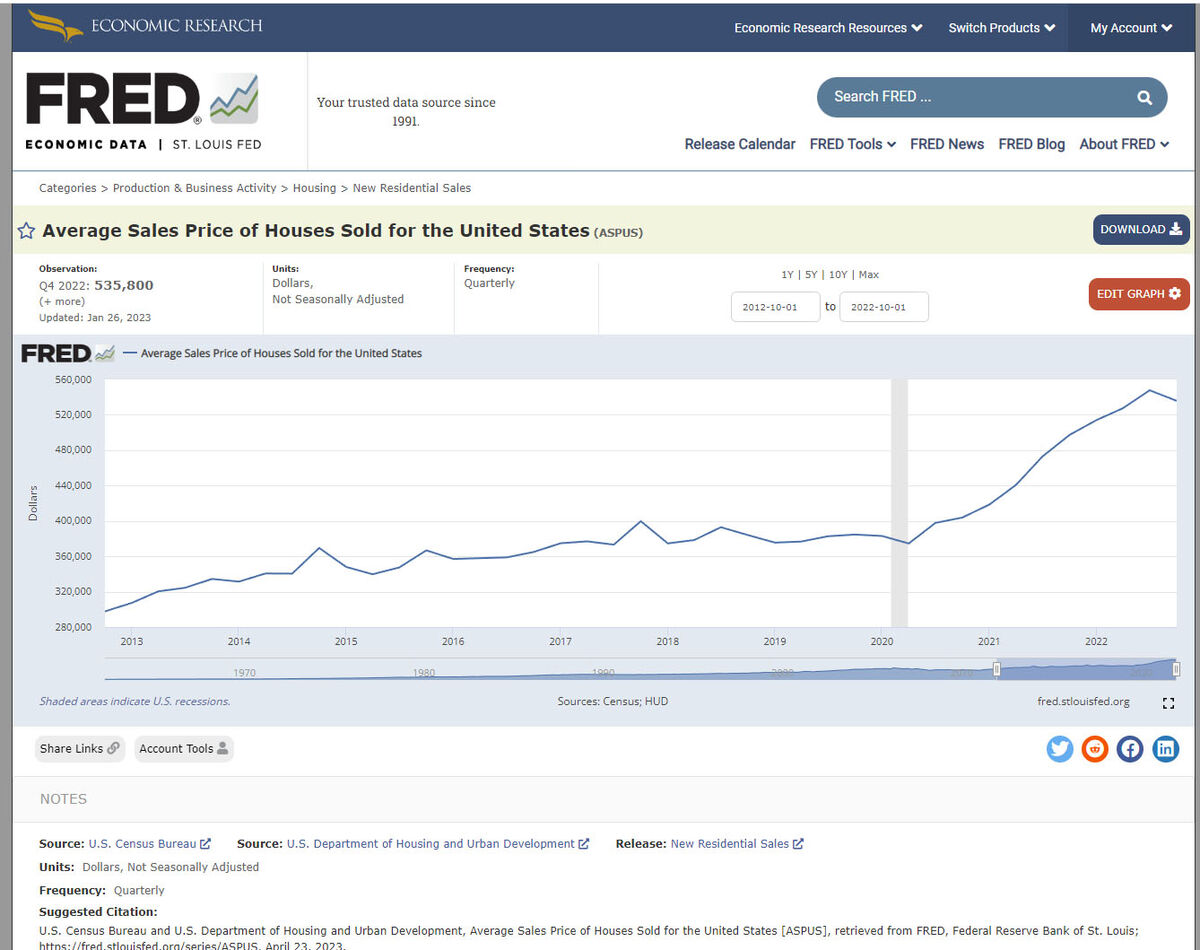

https://fred.stlouisfed.org/series/ASPUS

Apr 23, 2023 16:53:43 #

Triple G wrote:

This isn't about middle class. Even at $239k, it would be difficult to afford a $400k mortgage.

At today's interest rate and with 7% down, ~$170K/Year would qualify for a 30Y-$400K mortgage. It was much lower a year ago before the Fed began spiking the rates.

Apr 23, 2023 16:41:51 #

dlwhawaii wrote:

Where did you get the idea that 50% of the US population is considered middle class?

Do your own research lazy. It's not hard to find that stat at all.

Apr 23, 2023 10:32:41 #

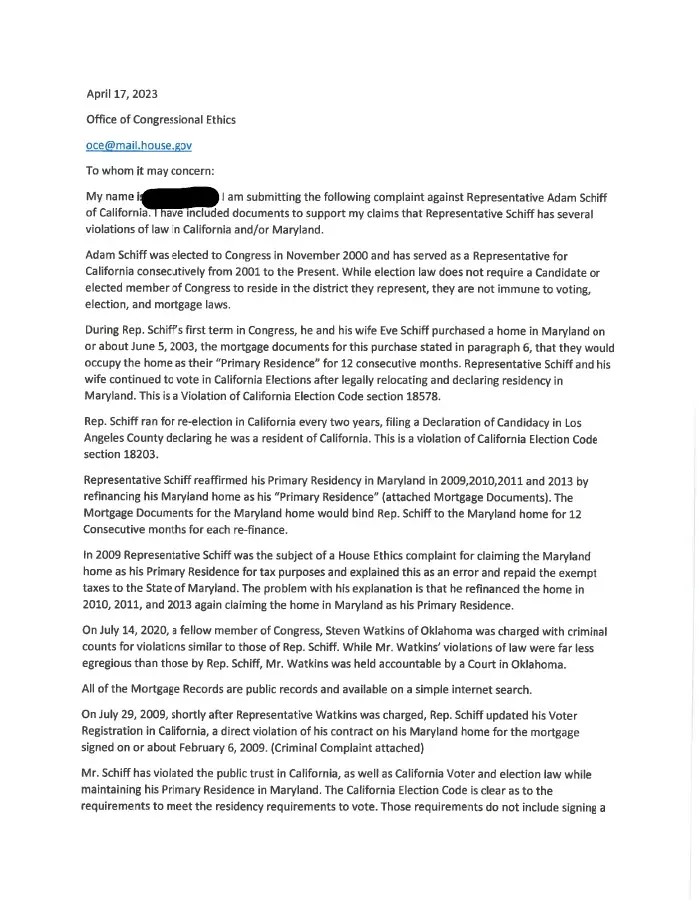

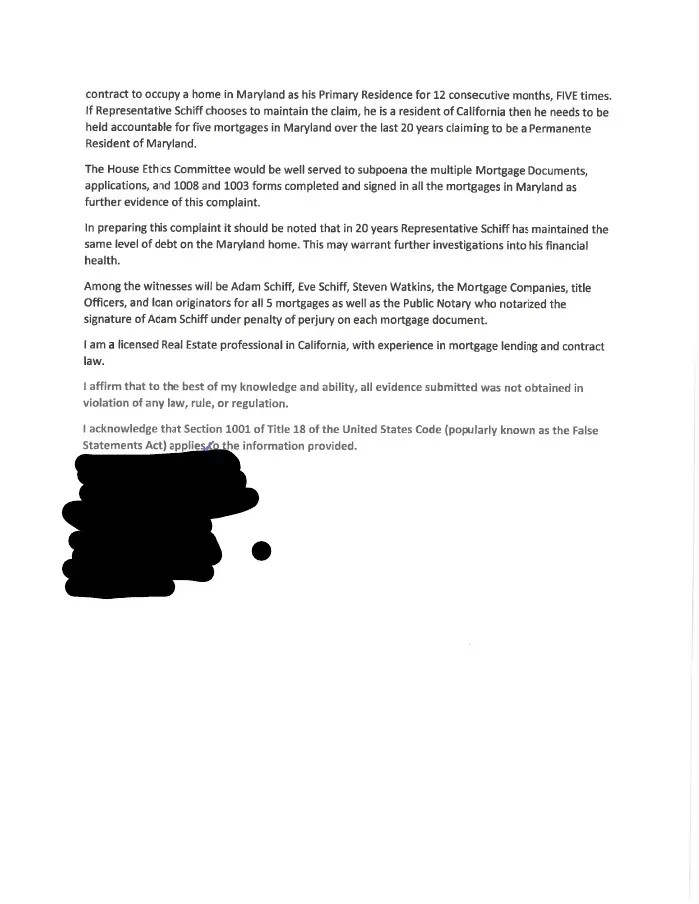

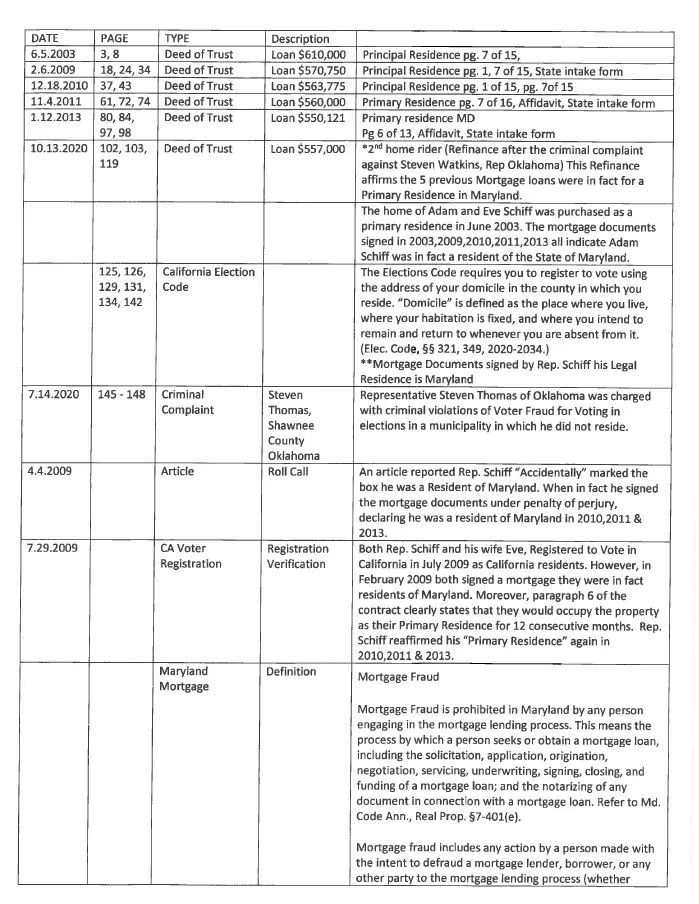

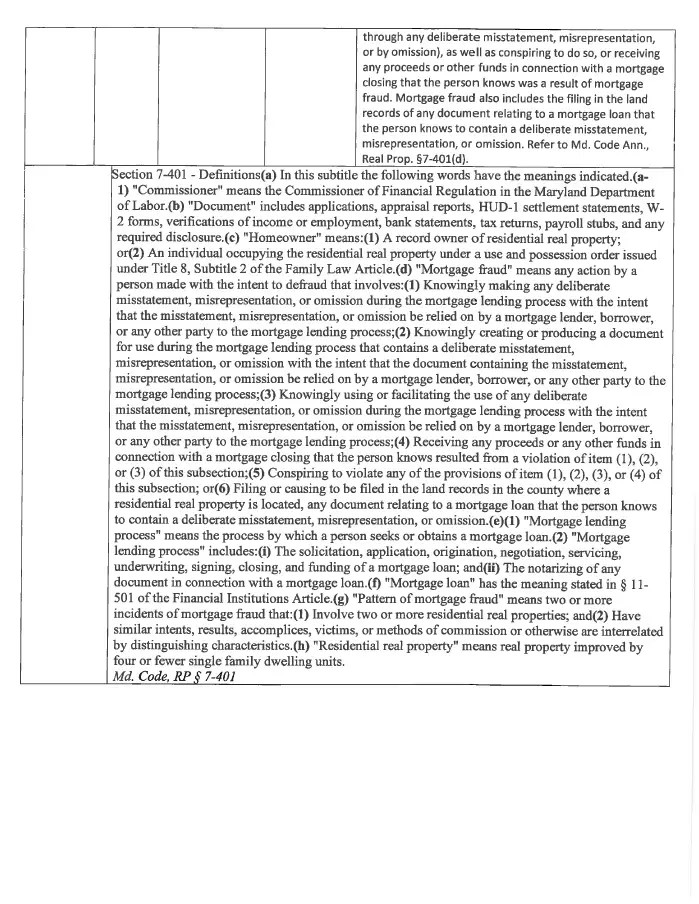

https://www.scribd.com/document/640102301/Schiff-Complaint#

https://www.scribd.com/document/640102300/Schiff-Evidence#download&from_embed

https://www.scribd.com/document/640102300/Schiff-Evidence#download&from_embed

Apr 23, 2023 09:16:54 #

dlwhawaii wrote:

You do realize that median means same amount of homes sold above AND below the median price? If you can't afford a house, don't buy one. If you can't afford a $400K house, look for a $300K house.

Statistics apparently isn't your strong suit.

Approx. 50% of the US population is considered middle class. Statistically, they are the ones buying homes in the median price range.

Apr 23, 2023 09:15:01 #

I remember this same issue when computers evolved enough and started to deploy into the working world. They did ultimately drastically change and even eliminate a great many jobs, not to mention displacing a large number of workers. But they also created a huge number of new jobs and opportunities. Ai will do the same in the long run.

Ai as it sits now though is still in the "wild west" stage, so there will be some bad actors and outcomes as well as good, just as there have been with computers.

Ai as it sits now though is still in the "wild west" stage, so there will be some bad actors and outcomes as well as good, just as there have been with computers.

Apr 23, 2023 08:59:28 #

HOHIMER wrote:

Ruthlessrider said:…. in a nation as rich as this one, we should care for those left behind by the economic and social progress we strive for, …….

Alas. Therein lies the conundrum. To discern those who would s**m the system from those in honest, authentic, need.

It is becoming increasingly apparent the default setting for the human psyche, seems to be trending toward lackluster.

Alas. Therein lies the conundrum. To discern those who would s**m the system from those in honest, authentic, need.

It is becoming increasingly apparent the default setting for the human psyche, seems to be trending toward lackluster.

Well stated!!!

Apr 23, 2023 08:47:08 #

DennyT wrote:

And sadly said either of those two as the candidate will likely give america another 4 years of Biden.

More than anything, I fear Biden dying while in office. Next in line is the first person that was tossed in the Dem primary. Even the Dem v**ers recognized that she is a complete nut bag.

Apr 21, 2023 17:29:50 #

Triple G wrote:

I do not consider a home loan of >$400k a "middle class" issue.

https://myfox8.com/news/money-matters/high-credit-scores-will-mean-higher-mortgage-rates-for-homebuyers-under-new-federal-rule/amp/

https://www.debt.org/faqs/americans-in-debt/demographics/

https://www.bankrate.com/mortgages/why-debt-to-income-matters-in-mortgages/

https://myfox8.com/news/money-matters/high-credit-scores-will-mean-higher-mortgage-rates-for-homebuyers-under-new-federal-rule/amp/

https://www.debt.org/faqs/americans-in-debt/demographics/

https://www.bankrate.com/mortgages/why-debt-to-income-matters-in-mortgages/

That's because you are clueless and can't even comprehend the material in the very links you supplied!

Median home price in the US is now OVER 400K

https://www.redfin.com/us-housing-market

Apr 21, 2023 12:42:26 #

Triple G wrote:

Hasn't your credit score always affected access an... (show quote)

Of course it does, and it is based on one's historical responsibility with debt and bill paying.

This rule most taxes those in the middle class who've managed both responsibly and rewards those who have not managed their debt and bills responsibly. I say middle class because they take out far more mortgages than the wealthy do. I've not had a mortgage in over 20 years despite having purchased two homes during that time.

Apr 21, 2023 12:10:46 #

https://news.yahoo.com/biden-rule-redistribute-high-risk-211102885.html

A Biden administration rule is set to take effect that will force good-credit home buyers to pay more for their mortgages to subsidize loans to higher-risk borrowers.

Experts believe that borrowers with a credit score of about 680 would pay around $40 more per month on a $400,000 mortgage under rules from the Federal Housing Finance Agency that go into effect May 1, costs that will help subsidize people with lower credit ratings also looking for a mortgage, according to a Washington Times report Tuesday.

"The changes do not make sense. Penalizing borrowers with larger down payments and credit scores will not go over well," Ian Wright, a senior loan officer at Bay Equity Home Loans, told the Times. "It overcomplicates things for consumers during a process that can already feel overwhelming with the amount of paperwork, jargon, etc. Confusing the borrower is never a good thing."

The Federal Housing Finance Agency, which oversees federally backed home mortgage companies Fannie Mae and Freddie Mac, has long sought to give consumers more affordable housing options. But those who work in the industry believe the new rules will only serve to frustrate and confuse people.

"This confusing approach won’t work and more importantly couldn’t come at a worse time for an industry struggling to get back on its feet after these past 12 months," David Stevens, a former commissioner of the Federal Housing Administration during the Obama administration, wrote in a social media post responding to the new rules. "To do this at the onset of the spring market is almost offensive to the market, consumers, and lenders."

The rules come as the housing market has struggled in the wake of multiple interest rate increases by the Federal Reserve.

Under the new rules, consumers with lower credit ratings and less money for a down payment would qualify for better mortgage rates than they otherwise would have.

Federal Housing Finance Agency Director Sandra Thompson said the new rules are designed to "increase pricing support for purchase borrowers limited by income or by wealth" and comes with "minimal" fee changes.

While Stevens agreed there was a gap in opportunity for low-income — especially minority — borrowers to qualify for affordable homes, he argued that attempting to manipulate prices was not the solution.

"Why was this done? The answer is simple, it was to try to narrow the gap in access to credit, especially for minority home buyers who often have lower down payments and lower credit scores," Stevens said.

"The gap in homeownership opportunity is real. America is facing a severe shortage of affordable homes for sales combined with excessive demand causing an imbalance. But convoluting pricing and credit is not the way to solve this problem."

A Biden administration rule is set to take effect that will force good-credit home buyers to pay more for their mortgages to subsidize loans to higher-risk borrowers.

Experts believe that borrowers with a credit score of about 680 would pay around $40 more per month on a $400,000 mortgage under rules from the Federal Housing Finance Agency that go into effect May 1, costs that will help subsidize people with lower credit ratings also looking for a mortgage, according to a Washington Times report Tuesday.

"The changes do not make sense. Penalizing borrowers with larger down payments and credit scores will not go over well," Ian Wright, a senior loan officer at Bay Equity Home Loans, told the Times. "It overcomplicates things for consumers during a process that can already feel overwhelming with the amount of paperwork, jargon, etc. Confusing the borrower is never a good thing."

The Federal Housing Finance Agency, which oversees federally backed home mortgage companies Fannie Mae and Freddie Mac, has long sought to give consumers more affordable housing options. But those who work in the industry believe the new rules will only serve to frustrate and confuse people.

"This confusing approach won’t work and more importantly couldn’t come at a worse time for an industry struggling to get back on its feet after these past 12 months," David Stevens, a former commissioner of the Federal Housing Administration during the Obama administration, wrote in a social media post responding to the new rules. "To do this at the onset of the spring market is almost offensive to the market, consumers, and lenders."

The rules come as the housing market has struggled in the wake of multiple interest rate increases by the Federal Reserve.

Under the new rules, consumers with lower credit ratings and less money for a down payment would qualify for better mortgage rates than they otherwise would have.

Federal Housing Finance Agency Director Sandra Thompson said the new rules are designed to "increase pricing support for purchase borrowers limited by income or by wealth" and comes with "minimal" fee changes.

While Stevens agreed there was a gap in opportunity for low-income — especially minority — borrowers to qualify for affordable homes, he argued that attempting to manipulate prices was not the solution.

"Why was this done? The answer is simple, it was to try to narrow the gap in access to credit, especially for minority home buyers who often have lower down payments and lower credit scores," Stevens said.

"The gap in homeownership opportunity is real. America is facing a severe shortage of affordable homes for sales combined with excessive demand causing an imbalance. But convoluting pricing and credit is not the way to solve this problem."

Apr 21, 2023 11:40:58 #

DennyT wrote:

I am not understanding the point of this .

It is entirely the tax payer that decides on refund or underpayment amount not the government.

Just me but I would always rather pay than let the government use my money interest free.

It is entirely the tax payer that decides on refund or underpayment amount not the government.

Just me but I would always rather pay than let the government use my money interest free.

Apr 21, 2023 07:56:03 #

dpullum wrote:

Again WNYShooter you post an article reference expecting others to read it for you... if you have read the info you would have an opinion. You it appears have none.

First question: WNYShooter please define "Woke"

First question: WNYShooter please define "Woke"

dpullum, Very sorry to confuse you with big words, but please help yourself and do your own research[/quote]

You can start here:

https://www.merriam-webster.com/

https://www.dictionary.com/

https://dictionary.cambridge.org/

Apr 21, 2023 06:30:14 #