Sales Tax and the Internet

Oct 14, 2018 10:56:15 #

jbk224 wrote:

Torch again...I am interested in your concept here. Can you please elaborate and share how you have been suppressed by the government(s), particularly through their taxing authority? And, is there someplace else in the world that you can suggest that will be better? Thanks in advance.

LOL, here we go...again!

Oct 14, 2018 11:15:55 #

As usual, the intent of the original post has been lost. The point is, will this potentially lead to the resurgence of the local camera store?

Oct 14, 2018 11:53:03 #

jerryc41 wrote:

I've been getting email from eBay about this for quite a while. Why wouldn't politicians want to collect more tax? Eventually, if you live in NY and make a purchase from a seller in CA, you'll have to pay sales tax on that. Yes, you will have to pay state sales tax on a sale that did not take place in your state. And that makes sense?

Jerry, Most sales tax laws are titled as Sales & Use taxes so if you buy something out of state, and the seller doesn't collect your state taxes, the law requires you to pay the amount of tax directly to your state. Some years ago when we had a small business and were undergoing a Sales Tax Audit, the auditor told me that it was the shortest customer line in the Government.

With the Supreme Court changing its position so all states are free to collect such taxes; it may be reasonable to check the comparative tax rates for large cost purchases. NY tax is, I believe, about 8.85% whereas our tax in MD is 6.0%--$1.15 per $100 or $.25 per hundred so a single ink Canon CLT-8 ink will be $0.02 more, hardly worth the trouble for individual cartridges, but if buying in bulk....?

Just as an aside, did you know the NYC sales tax was introduced shortly after the start of WW II AS A TEMPORARY TAX to help offset some of the city's war costs? IT WAS TO BE REVOKED AT THE END OF THE WAR!

Oct 14, 2018 12:21:33 #

RRS

Loc: Not sure

Bill_de wrote:

Come on, your SS is going up 2.8% next year. Of course I don't know how much Medicare is going up.

--

--

I for one don't ever want another increase in SS, why you ask, well we never actually see it because as we know whatever the increase is Medicare take all of it. Now the real problem, the increase now shows up as income for your Federal taxes and we wind up paying more taxes for money that we never see. It's a win win situation for the government, more funding for Medicare and more money collected for taxes.

Oct 14, 2018 12:25:53 #

RRS

Loc: Not sure

David Kay wrote:

Oh yes, that will work just fine. Who pays the shipping for the forwarding? You do. So how are you ahead?

On $20,000.00 , pro body, 600mm f/4.0 and a 1.4 extender I'd say pretty far ahead.

Oct 14, 2018 12:28:48 #

jbk224

Loc: Long Island, NY

JCam wrote:

Jerry, Most sales tax laws are titled as Sales &a... (show quote)

Jcam, basically right on. However the SC decision requires vendors to collect the applicable tax for the state to which the item is being sent. This is the big view. Other details allow exemptions. Therefore, the differences in the rates of the vendor’s state is not germane.

Oct 14, 2018 12:35:30 #

RRS

Loc: Not sure

DaveO wrote:

You can count on me to keep quiet...just don't show up again in Yellowstone next June!

I won't Dave, we are going in May. We might be back in June if our grandson can get 5 or 6 days off from his job on the farm, yes I know he's only 13 but a hard worker.

Oct 14, 2018 13:00:02 #

epd1947 wrote:

And what exactly is wrong with shopping locally in your own community? - provides jobs there at the very least. Your sales taxes provide a portion of the funds used by local governments to provide services you and your neighbors rely on - it's all a part of being in a society.

Nothing is wrong with the local store but since digital came into it's own there has been only one major store left in the city and with no competition you get what they want you to get.

Oct 14, 2018 13:10:33 #

In response to LargoBob's post about ordering from B&H without state sales tax:

Not anymore. I live in KY and this week received notice from B&H that they are now charging sales tax on sales shipped to KY as of Oct. 12.

Not anymore. I live in KY and this week received notice from B&H that they are now charging sales tax on sales shipped to KY as of Oct. 12.

Oct 14, 2018 13:28:13 #

Since my move to New Hampshire, which is a no sales tax State, if I travel to a State which has a sales tax, will I be refunded the tax when I go home to NH?

B

B

Oct 14, 2018 16:19:07 #

RRS wrote:

I won't Dave, we are going in May. We might be back in June if our grandson can get 5 or 6 days off from his job on the farm, yes I know he's only 13 but a hard worker.

We arrive June 13 for a month, so we'll hope for the best!

Luckily some youngsters can experience the value and meaning of hard work!

Oct 14, 2018 16:34:51 #

Oct 15, 2018 01:11:26 #

Looks like it's time to find a State without sales tax to do business with.

Oct 15, 2018 06:45:50 #

Oct 15, 2018 10:20:37 #

Tomcat5133

Loc: Gladwyne PA

MadMikeOne wrote:

Your statement that B&H does not charge sales tax to NJ customers is incorrect. B&H has a distribution center in Florence, NJ and has been required to charge sales tax for orders shipped to customers in NJ for well over a year. Also, IâÃÂÃÂm pretty sure B&H is also required to charge NY state sales tax for items purchased in its NY store as well as to internet purchasers with a NY mailing address.

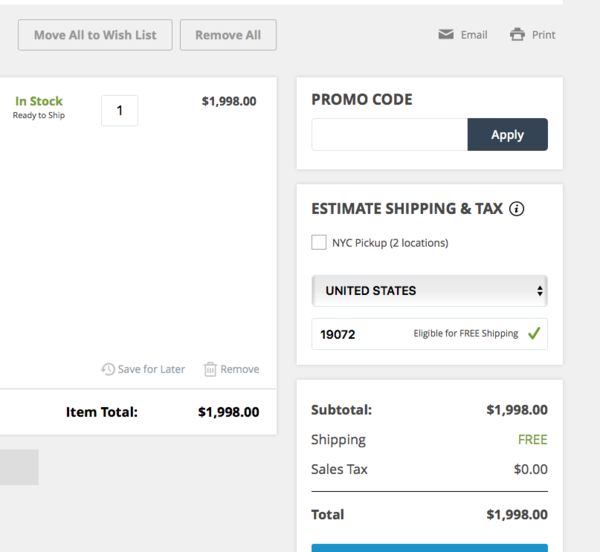

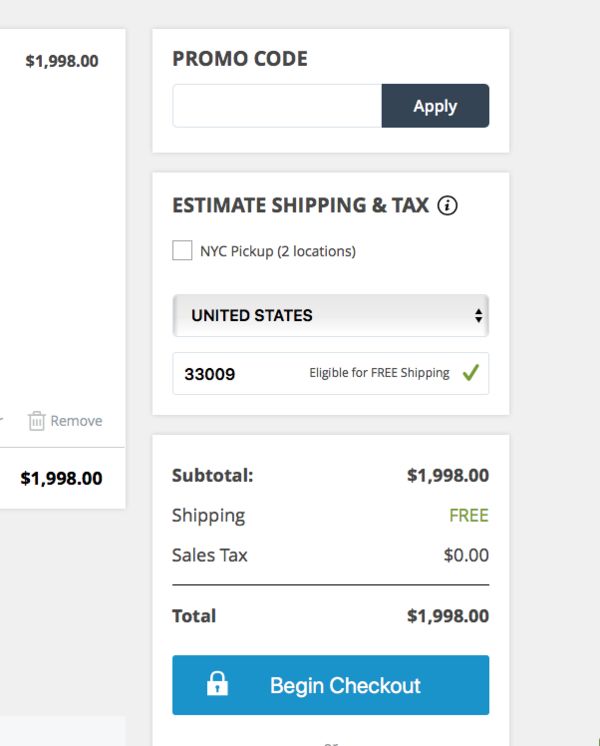

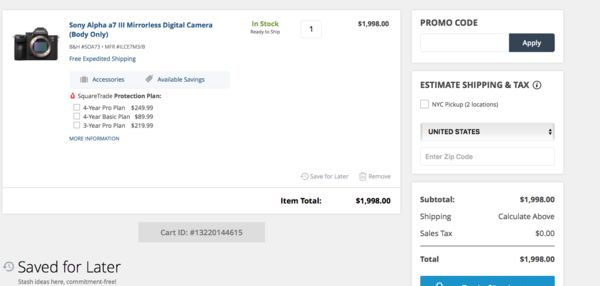

I lived and worked in PA for years. Now in FL. Here is the zip code response to ship to both states.

Yes B&H might vary from different places. NJ could be taxed.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.