More on Biden's Student Loan Plan

Apr 26, 2024 13:12:00 #

Biden's New Student Loan Forgiveness Plan Costs Taxpayers $559B and Benefits 6-Figure Income Households More Than Anyone

https://www.msn.com/en-us/money/personalfinance/biden-s-new-student-loan-forgiveness-plan-costs-taxpayers-559b-and-benefits-6-figure-income-households-more-than-anyone/ss-AA1nHV9z?ocid=msedgntp&pc=DCTS&cvid=7eece753770c44139e7fb66d4374a515&ei=42

https://www.msn.com/en-us/money/personalfinance/biden-s-new-student-loan-forgiveness-plan-costs-taxpayers-559b-and-benefits-6-figure-income-households-more-than-anyone/ss-AA1nHV9z?ocid=msedgntp&pc=DCTS&cvid=7eece753770c44139e7fb66d4374a515&ei=42

Apr 26, 2024 18:54:22 #

Apr 26, 2024 23:45:30 #

FrumCA wrote:

Biden's New Student Loan Forgiveness Plan Costs Taxpayers $559B and Benefits 6-Figure Income Households More Than Anyone

https://www.msn.com/en-us/money/personalfinance/biden-s-new-student-loan-forgiveness-plan-costs-taxpayers-559b-and-benefits-6-figure-income-households-more-than-anyone/ss-AA1nHV9z?ocid=msedgntp&pc=DCTS&cvid=7eece753770c44139e7fb66d4374a515&ei=42

https://www.msn.com/en-us/money/personalfinance/biden-s-new-student-loan-forgiveness-plan-costs-taxpayers-559b-and-benefits-6-figure-income-households-more-than-anyone/ss-AA1nHV9z?ocid=msedgntp&pc=DCTS&cvid=7eece753770c44139e7fb66d4374a515&ei=42

Apr 27, 2024 01:11:08 #

Too bad it's not that simple.

There is no such thing as “forgiveness,” and student loan debt does not go away—it remains on the federal government’s books. Cancelation alone is estimated to cost at least $400 billion dollars. The Biden administration simply moved the loan debt, agreed to by millions of student loan borrowers, onto the backs of American taxpayers. Biden’s student loan bailout will cost every taxpayer, even those who never went to college, at least $2,500.

There is no such thing as “forgiveness,” and student loan debt does not go away—it remains on the federal government’s books. Cancelation alone is estimated to cost at least $400 billion dollars. The Biden administration simply moved the loan debt, agreed to by millions of student loan borrowers, onto the backs of American taxpayers. Biden’s student loan bailout will cost every taxpayer, even those who never went to college, at least $2,500.

Apr 27, 2024 07:52:13 #

Does this mean when can claim “College Student” as a dependent on our tax return this year.😊

Apr 27, 2024 09:28:25 #

I tried to find out but couldn’t .

Given How Rix explained it, is the cost to tax payers in reality lost income over future years.?

Given How Rix explained it, is the cost to tax payers in reality lost income over future years.?

Apr 27, 2024 10:49:00 #

DennyT wrote:

I tried to find out but couldn’t .

Given How Rix explained it, is the cost to tax payers in reality lost income over future years.?

Given How Rix explained it, is the cost to tax payers in reality lost income over future years.?

Maybe it can be written off as a bad loan.

Apr 27, 2024 12:11:24 #

FrumCA wrote:

Maybe it can be written off as a bad loan.

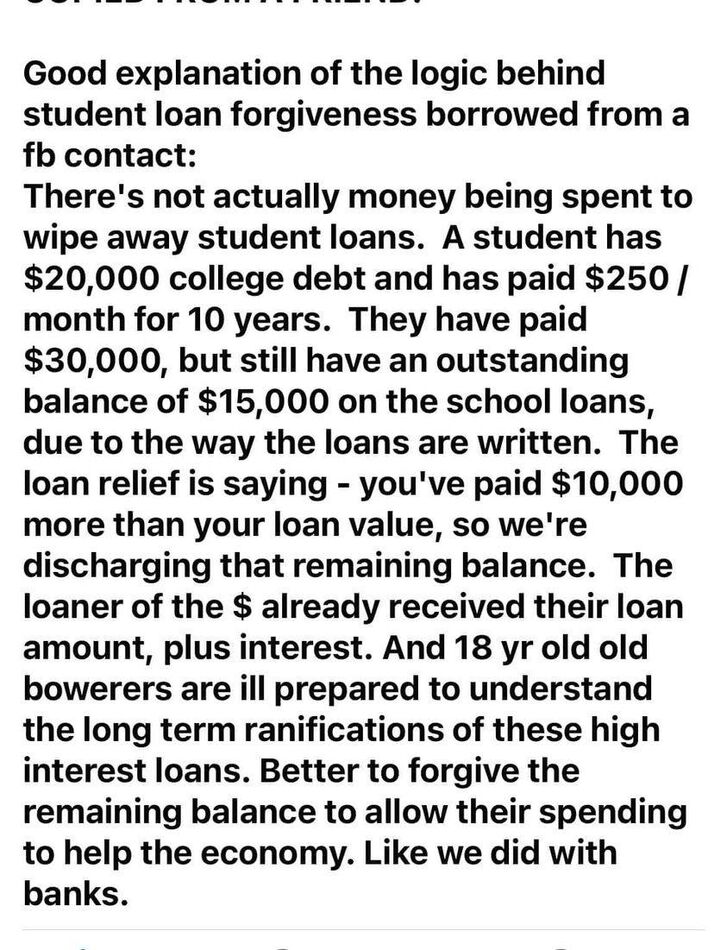

That’s not what I ask . If a student borrowed 20k and has already paid back 30 and still owes 15 because of the loan structure how can that be costing the government anything. ?

Apr 27, 2024 12:22:58 #

DennyT wrote:

That’s not what I ask . If a student borrowed 20k and has already paid back 30 and still owes 15 because of the loan structure how can that be costing the government anything. ?

As I said, it's because the debt stays on the government's books.

Apr 27, 2024 13:19:10 #

Effate

Loc: El Dorado Hills, Ca.

DennyT wrote:

That’s not what I ask . If a student borrowed 20k and has already paid back 30 and still owes 15 because of the loan structure how can that be costing the government anything. ?

Seems to me, and I don’t know, if Sallie Mae or a third party loan servicing company has the loan and the government is merely guaranteeing it then how is the taxpayer not on the hook for the balance regardless of the student’s payment history? Additionally, if you enter into an offer and compromise with a lender or credit card company doesn’t it wound your credit for a period (until rebuilt) and if so shouldn’t it happen to these students. Also no matter how you parse this argument using examples such as a person who has paid much more than the original loan is probably an exception rather than the rule and to lump everyone in the same basket regardless of history, need, etc. is merely buying votes and thumbing your nose at a SCOTUS ruling.

Apr 27, 2024 15:02:06 #

Apr 27, 2024 15:03:54 #

Effate wrote:

Seems to me, and I don’t know, if Sallie Mae or a ... (show quote)

I think the discussion is about government loans no government guaranteed loans. Not sure.

Apr 27, 2024 15:05:48 #

FrumCA wrote:

As I said, it's because the debt stays on the government's books.

Then it is an accounting debt that has already been paid.

Right and is no cost to tax payer

Apr 27, 2024 16:07:02 #

Effate wrote:

Seems to me, and I don’t know, if Sallie Mae or a ... (show quote)

One we are talking about direct government loans and two even in guaranteed loans government is only on the hook “ the student “ defaults. Do you have any source showing this is the case. ?

I don’t like real debts to be forgiven but some honesty is needed without spinning the numbers for pure political reasons .

Apr 27, 2024 16:15:16 #

Effate

Loc: El Dorado Hills, Ca.

DennyT wrote:

One we are talking about direct government loans and two even in guaranteed loans government is only on the hook “ the student “ defaults. Do you have any source showing this is the case. ?

I don’t like real debts to be forgiven but some honesty is needed without spinning the numbers for pure political reasons .

I don’t like real debts to be forgiven but some honesty is needed without spinning the numbers for pure political reasons .

I don’t favor one person being forgiven a dime that they are obligated to pay absent a showing of lender fraud or a school going broke leaving students high and dry (Trump U anyone). I’ll put that right up front but if there is any political spin it rests clearly on the party who is defying SCOTUS and buying votes.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.