Tax the Rich

Apr 19, 2024 09:30:04 #

Apr 19, 2024 09:36:54 #

RixPix wrote:

So you know…

They forgot where they run many expenses through as business expenses so debt interest on that money is tax deductible.

"Interest paid on personal loans, car loans, and credit cards is generally not tax-deductible. However, you may be able to claim interest you've paid when you file your taxes if you take out a loan or accrue credit card charges to finance business expenses."

Apr 19, 2024 11:32:09 #

https://www.brookings.edu/articles/five-myths-about-the-47-percent/&ved=2ahUKEwj5kP_My86FAxW_NzQIHeeMCd0QFnoECCkQAQ&usg=AOvVaw0qRnjbR-ZxCNYy8C6fsfhX" rel="nofollow" target="_blank">https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://www.brookings.edu/articles/five-myths-about-the-47-percent/&ved=2ahUKEwj5kP_My86FAxW_NzQIHeeMCd0QFnoECCkQAQ&usg=AOvVaw0qRnjbR-ZxCNYy8C6fsfhX

The Left continues going after Big Business saying they need to pay their fair share of taxes. But what about the 47% group who pay little to sometimes no federal and state income taxes? What is their fair share?

Dennis

The Left continues going after Big Business saying they need to pay their fair share of taxes. But what about the 47% group who pay little to sometimes no federal and state income taxes? What is their fair share?

Dennis

Apr 19, 2024 11:43:05 #

dennis2146 wrote:

https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://www.brookings.edu/articles/five-myths-about-the-47-percent/&ved=2ahUKEwj5kP_My86FAxW_NzQIHeeMCd0QFnoECCkQAQ&usg=AOvVaw0qRnjbR-ZxCNYy8C6fsfhX

The Left continues going after Big Business saying they need to pay their fair share of taxes. But what about the 47% group who pay little to sometimes no federal and state income taxes? What is their fair share?

Dennis

The Left continues going after Big Business saying they need to pay their fair share of taxes. But what about the 47% group who pay little to sometimes no federal and state income taxes? What is their fair share?

Dennis

For a change I agree. My choices for tax system are (1) FAIR tax (2) Flat tax in that order .

Apr 19, 2024 11:45:17 #

DennyT wrote:

For a change I agree. My choices for tax system are (1) FAIR tax (2) Flat tax in that order .

lil denny we have agreed several times. Or at least I have pointed out I agreed with you but you refused to understand and/or accept it. Thank you for agreeing this time but there would be far less friction between us if only you would pay attention to reading comprehension.

Dennis

Apr 19, 2024 12:04:35 #

RixPix wrote:

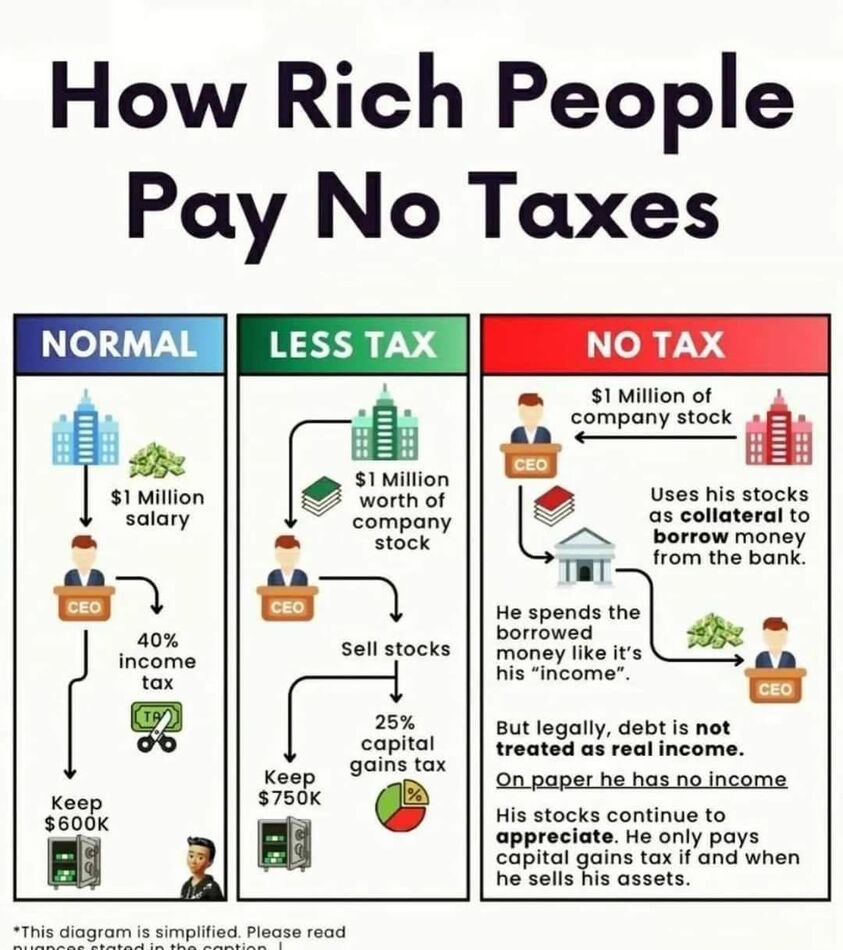

So you know…

Total BullS**t.

https://imc-cpa.com/blog/tax-consequences-of-your-executive-compensation-package/

Apr 19, 2024 12:05:13 #

dennis2146 wrote:

https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://www.brookings.edu/articles/five-myths-about-the-47-percent/&ved=2ahUKEwj5kP_My86FAxW_NzQIHeeMCd0QFnoECCkQAQ&usg=AOvVaw0qRnjbR-ZxCNYy8C6fsfhX

The Left continues going after Big Business saying they need to pay their fair share of taxes. But what about the 47% group who pay little to sometimes no federal and state income taxes? What is their fair share?

Dennis

The Left continues going after Big Business saying they need to pay their fair share of taxes. But what about the 47% group who pay little to sometimes no federal and state income taxes? What is their fair share?

Dennis

The entire topic is about the people you mentioned; not about business!

Apr 19, 2024 12:06:29 #

dennis2146 wrote:

lil denny we have agreed several times. Or at least I have pointed out I agreed with you but you refused to understand and/or accept it. Thank you for agreeing this time but there would be far less friction between us if only you would pay attention to reading comprehension.

Dennis

Dennis

Ahem, you just proved your lack of comprehension.

Apr 19, 2024 12:13:05 #

Triple G wrote:

The entire topic is about the people you mentioned; not about business!

Yes I know. But the Left DOES continue going after Big Business regarding taxes doesn't it. THAT is my point. Do you not understand many if not ALL of the topics posted here will veer off the main path some much sooner than others. It happens all the time and every day. Not one stays on topic always. You do know this don't you?

Just today there was a topic I posted on Biden and one of the most lying corrupt Left Wingers known to this forum, CLOWN Boy lil tex decided to make a topic strictly about Biden more about President Trump. Maybe you saw it. The entire topic was ONLY Biden but so shallow is the thinking of the Left, that would be YOU, you cannot stick to the topic of Biden. For some reason the Left feels me pointing out negative comments about Biden cannot be rectified by simply pointing out positive comments about Biden. As there are NO positive comments to be brought up you the Left attack Trump instead.

What a fantastic way of pointing out I am right in my negative comments about POS Biden when there are no positive comments the Left can point out.

Dennis

Apr 19, 2024 12:15:17 #

Triple G wrote:

Ahem, you just proved your lack of comprehension.

What a dumb comment that was. Keep up your asinine comments. You only make me look great.

Dennis

Apr 19, 2024 12:24:25 #

dennis2146 wrote:

What a dumb comment that was. Keep up your asinine comments. You only make me look great.

Dennis

Dennis

I have a picture of you looking great.

Apr 19, 2024 12:29:40 #

Blurryeyed wrote:

From the article you posted.

"But with a Section 83(b) e******n, you can instead recognize ordinary income when you receive the stock. This e******n, which you must make within 30 days after receiving the stock, allows you to convert potential future appreciation from ordinary income to long-term capital gains income and defer it until the stock is sold."

It's you with the BS shovel.

How does it differ from OP?

Apr 19, 2024 12:30:34 #

Triple G wrote:

The entire topic is about the people you mentioned; not about business!

Yes, but if you look at the tax consequences of stock options the OP is completely erroneous.

Apr 19, 2024 12:48:58 #

Triple G wrote:

From the article you posted.

"But with a Section 83(b) e******n, you can instead recognize ordinary income when you receive the stock. This e******n, which you must make within 30 days after receiving the stock, allows you to convert potential future appreciation from ordinary income to long-term capital gains income and defer it until the stock is sold."

It's you with the BS shovel.

How does it differ from OP?

"But with a Section 83(b) e******n, you can instead recognize ordinary income when you receive the stock. This e******n, which you must make within 30 days after receiving the stock, allows you to convert potential future appreciation from ordinary income to long-term capital gains income and defer it until the stock is sold."

It's you with the BS shovel.

How does it differ from OP?

Because you have to claim the initial stock value as income and appreciation there after becomes gains, or you can differ claiming the stock at which time the value of the appreciated stock will have to be declared as income when it vests... you have 30 days to make that decision.

You are paying income tax on the stock gift either way, gains only apply to future appreciation and if you don't differ then you pay income tax on the total value at some point in the future.

The scenarios in his post are wrong, especially the third scenario is totally BS.

Apr 19, 2024 13:02:09 #

Blurryeyed wrote:

Yes, but if you look at the tax consequences of stock options the OP is completely erroneous.

Where were options mentioned in OP?

What's BS as you called it?

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.