where do you fit in this chart and I hope I am not booted to the attic

Feb 13, 2024 12:15:03 #

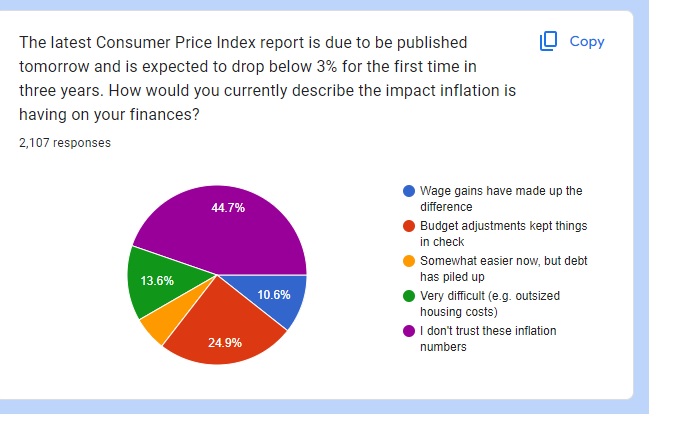

an investing website I use posted the results of a survey yesterday before the CPI latest info. I found the 44% that do not trust the numbers interesting. This survey was based on respondents and would be considered non scientific.

Feb 13, 2024 12:19:57 #

Feb 13, 2024 12:30:29 #

Feb 13, 2024 12:37:19 #

I don't fit into any of those categories either.

1. I didn't have any wage gain so of course it doesn't make up for the difference.

2. I keep things in check without having to adjust my budget.

3. I have no debt.

4. It's not difficult.

5. The inflation number is real as I saw prices went up significantly.

1. I didn't have any wage gain so of course it doesn't make up for the difference.

2. I keep things in check without having to adjust my budget.

3. I have no debt.

4. It's not difficult.

5. The inflation number is real as I saw prices went up significantly.

Feb 13, 2024 12:40:36 #

Inflation is a ratchet. It raises prices, but when inflation drops back to reasonable levels the prices don't. They stay high. Being retired, my income does not inflate much, certainly it doesn't follow the CPI numbers. Social Security applies a COLA but the numbers are chosen by the bureaucracy.

Housing is probably the worst problem now. We have been looking for a house for almost a year. We looked at housing prices before we started. From then until now the prices have gone up 50-100%.

Housing is probably the worst problem now. We have been looking for a house for almost a year. We looked at housing prices before we started. From then until now the prices have gone up 50-100%.

Feb 13, 2024 12:49:52 #

home brewer wrote:

an investing website I use posted the results of a survey yesterday before the CPI latest info. I found the 44% that do not trust the numbers interesting. This survey was based on respondents and would be considered non scientific.

You asked the question so may I ask you a question? Where do you fit in this chart?

Feb 13, 2024 12:51:13 #

home brewer wrote:

an investing website I use posted the results of a survey yesterday before the CPI latest info. I found the 44% that do not trust the numbers interesting. This survey was based on respondents and would be considered non scientific.

Between us my wife and I have our pensions, SS & my VA disability. We were steadily building up a savings account. We now are mostly not adding to the savings, or only a small amount compared to before each month. We managed to pay for an outside remodel, repair stucco etc. and paint the house from the savings and still have over 6 months house payment, basic bills, food etc. in the savings.

One change, our cars don't get as much use because I bought a street legal electric mobility scooter which I use for my running around within 10 miles or so. I only take my SUV when I need room for "Stuff" on shopping trips. My bird photography in parks etc. I take the scooter. A full charge on the batteries costs way less than a gallon of gas. Even running it at top speed (30mph) like I do it gets 20-30 miles on a charge. If I was to drop to 15-20mph, the range would go up to nearly 40 for me. Someone lighter than me could approach 50.

Feb 13, 2024 13:04:51 #

BebuLamar wrote:

I don't fit into any of those categories either.

1. I didn't have any wage gain so of course it doesn't make up for the difference.

2. I keep things in check without having to adjust my budget.

3. I have no debt.

4. It's not difficult.

5. The inflation number is real as I saw prices went up significantly.

1. I didn't have any wage gain so of course it doesn't make up for the difference.

2. I keep things in check without having to adjust my budget.

3. I have no debt.

4. It's not difficult.

5. The inflation number is real as I saw prices went up significantly.

Feb 13, 2024 13:11:37 #

DirtFarmer wrote:

Inflation is a ratchet. It raises prices, but when... (show quote)

It really is sad. People tend to think that "we're back to normal" when the inflation rate goes down, but the overall price structure almost never reverses. It now just increases at a slower pace. It's very difficult for those whose income has not increased at a commensurate pace.

Feb 13, 2024 13:22:25 #

I think I should have said what do you think of the chart rather than where do you fit which is way too personal.

I was asked where do we fit? I think that since the CPI does not address fuel and food costs it is low. Also for many the cost of house and car insurance is out of the roof ( pun intended). Our living expenses for 2023 are up 14% since December 31, 2020

I was asked where do we fit? I think that since the CPI does not address fuel and food costs it is low. Also for many the cost of house and car insurance is out of the roof ( pun intended). Our living expenses for 2023 are up 14% since December 31, 2020

Feb 13, 2024 13:34:07 #

The issue is those in Washington do not worry about living expenses that increase and do not keep up. I know many people that are not keeping up and need to make choices that are not easy.

Feb 13, 2024 13:51:04 #

Fortunately we bought our house back in 2011 and interest rates were low. The only problem with that is that my mortgage company is deluging us with offers to refinance or take out equity. One email today and two mailers. It's getting ridiculous. We hope to pay this house off one day so we aren't biting. I feel for people trying to buy a house today. The first house we bought back in the old days was 14.5% interest. That house was half the price we paid for this one and the payment was higher than our current.

Feb 13, 2024 13:55:05 #

Feb 13, 2024 13:56:51 #

home brewer wrote:

The issue is those in Washington do not worry about living expenses that increase and do not keep up. I know many people that are not keeping up and need to make choices that are not easy.

Yes!

Many have to choose between food and prescriptions........

Feb 13, 2024 14:07:32 #

Several years back when interest was 2.5% we refinanced from the original 7+ and if they think I am refinancing at a higher rate they need their heads examined. I have it on auto-pay with an extra $500 on the principal, so the amount owned is going down at a nice steady rate.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.