PayPal and Income Tax

Mar 28, 2023 07:32:36 #

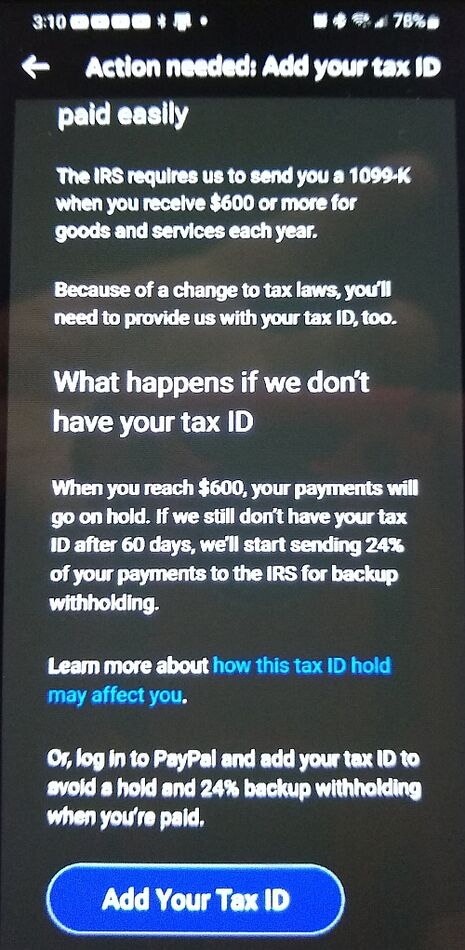

Apparently, this is new, but I don't understand it. I bought a ukulele from someone in Chicago, and she received this message from PayPal. She is new to PP. The image below was a small image display on my cell phone. I took a picture with another cell phone.

She's the one who wanted me to use "Friends and Family," but I didn't. Now, she thinks this is my fault because I sent a "Goods and Services" payment.

Form 1099-K - "Whether you own a business, are self-employed, work in the gig economy or are selling personal items, Form 1099-K includes the gross amount of all payment transactions. You may receive a Form 1099-K from each payment settlement entity from which you received payments in settlement of reportable payment transactions. A reportable payment transaction is defined as a payment card transaction or a third-party network transaction. A third party network transactions may include a payment through a payment app."

https://www.irs.gov/businesses/understanding-your-form-1099-k

EDIT: I think I found a loophole - "sold at a loss."

"If you receive a Form 1099-K for a personal item sold at a loss, report the information on Form 1040, Schedule 1, Additional Income and Adjustments to Income with offsetting transactions. For example, if you receive a Form 1099-K for selling your couch online for $700 you will report:

Part I – Line 8z – Other Income – Form 1099-K Personal Item Sold at a Loss $700

Part II – Line 24z – Other Adjustments - Form 1099-K Personal Item Sold at a Loss $700

The net effect of these two adjustments on adjusted gross income would be $0."

She's the one who wanted me to use "Friends and Family," but I didn't. Now, she thinks this is my fault because I sent a "Goods and Services" payment.

Form 1099-K - "Whether you own a business, are self-employed, work in the gig economy or are selling personal items, Form 1099-K includes the gross amount of all payment transactions. You may receive a Form 1099-K from each payment settlement entity from which you received payments in settlement of reportable payment transactions. A reportable payment transaction is defined as a payment card transaction or a third-party network transaction. A third party network transactions may include a payment through a payment app."

https://www.irs.gov/businesses/understanding-your-form-1099-k

EDIT: I think I found a loophole - "sold at a loss."

"If you receive a Form 1099-K for a personal item sold at a loss, report the information on Form 1040, Schedule 1, Additional Income and Adjustments to Income with offsetting transactions. For example, if you receive a Form 1099-K for selling your couch online for $700 you will report:

Part I – Line 8z – Other Income – Form 1099-K Personal Item Sold at a Loss $700

Part II – Line 24z – Other Adjustments - Form 1099-K Personal Item Sold at a Loss $700

The net effect of these two adjustments on adjusted gross income would be $0."

Mar 28, 2023 08:03:57 #

I'll guess that maybe "Friends & Family" is treated differently, tax wise.

The government is just attempting to cash in on the underground economy...

Going after any "income" that is traceable.

The government is just attempting to cash in on the underground economy...

Going after any "income" that is traceable.

Mar 28, 2023 08:13:42 #

Saycheeze

Loc: Ct

Friends and family payments aren’t subject to tax where goods and services payments are. This is because the irs lowered the ceiling on these type of payments from $10,000 to $600. If you were to pay friends and family you would loose your PayPal protection and PayPal charges the seller 3.5% if you pay goods and services

Mar 28, 2023 08:18:54 #

Saycheeze wrote:

Friends and family payments aren’t subject to tax where goods and services payments are. This is because the irs lowered the ceiling on these type of payments from $10,000 to $600. If you were to pay friends and family you would loose your PayPal protection and PayPal charges the seller 3.5% if you pay goods and services

I think that's 2.9%, and it's the one sending the money who must pay the fee. There is no protection because there is no physical object to protect. PayPal's protection is to make sure the item arrives in good condition. Since F&F does not involve an item, it does no need protection. If you pay for an item with F&F and then tell PP that the item was damaged, you're admitting that you cheated.

If the item is sold at a loss, the "income" doesn't count.

Mar 28, 2023 08:20:04 #

Unless it truly is a very close trusted friend or family, never use that option when purchasing an item. Like stated above, you lose all protection. I purchased an item for $150. I Never got it. It took about 10 days, and me saving all my communications. But I got my money back. If I’d used friends & family, I’d be screwed.

Mar 28, 2023 08:24:49 #

Spiney wrote:

Unless it truly is a very close trusted friend or family, never use that option when purchasing an item. Like stated above, you lose all protection. I purchased an item for $150. I Never got it. It took about 10 days, and me saving all my communications. But I got my money back. If I’d used friends & family, I’d be screwed.

Yes, definitely. If the seller doesn't want to pay the 2.9% fee, he should raise the price by 2.9% to make up for the loss.

Mar 28, 2023 08:41:03 #

tca2267

Loc: Florida

More BS for the average guy...

Why doesn't the IRS go after the real tax evaders like the POS Al Sharpton!!!

Why doesn't the IRS go after the real tax evaders like the POS Al Sharpton!!!

Mar 28, 2023 09:12:57 #

StanMac

Loc: Tennessee

tca2267 wrote:

More BS for the average guy...

Why doesn't the IRS go after the real tax evaders like the POS Al Sharpton!!!

Why doesn't the IRS go after the real tax evaders like the POS Al Sharpton!!!

Yeah! Or TFG!

Stan

Mar 28, 2023 09:27:07 #

sueyeisert

Loc: New Jersey

There are many companies thatave paid no taxes like Verizon but this is a discussion for a different group.

Mar 28, 2023 09:55:06 #

DVZ

Loc: Littleton CO

sueyeisert wrote:

There are many companies thatave paid no taxes like Verizon but this is a discussion for a different group.

Which is great for us because Corporate tax is simply rolled into the cost of the product or service. The citizen tax payer and consumer pays for everything. The US has one of the higher Corporate taxes rates which you and I pay for when we purchase their products.

Mar 28, 2023 10:09:05 #

tca2267 wrote:

More BS for the average guy...

Why doesn't the IRS go after the real tax evaders like the POS Al Sharpton!!!

Why doesn't the IRS go after the real tax evaders like the POS Al Sharpton!!!

You know the answer to that!

Loren - in Beauitiful Baguio City

Mar 28, 2023 10:39:37 #

Jagnut07

Loc: South Carolina

So the corporate tax will work really well. If a company pays zero tax now and we raise the rate to 28%. What is 28% of zero?

I know, totally off topic but I couldn’t help myself.

I know, totally off topic but I couldn’t help myself.

Mar 28, 2023 10:48:24 #

I’m a little confused or maybe just lucky on who would get a 1099? Is it only commercial sellers? I know private people who sold goods last year for more than $600 using PayPal, but to my knowledge, never received a 1099. As for only accepting “friends and family” for payment, if you are diligent to minimize risk (like knowing your customer), it’s still acceptable.

Mar 28, 2023 12:18:42 #

Saycheeze

Loc: Ct

The last fee I paid was 3.5%. In many ads you are now seeing “net to me” others are saying no G&S

Mar 28, 2023 12:35:27 #

jerryc41 wrote:

Yes, definitely. If the seller doesn't want to pay the 2.9% fee, he should raise the price by 2.9% to make up for the loss.

Perhaps she doesn't want to pay the income tax so she wanted you to pay her as friends and family like you are giving her money and not for selling you the ukulele. You could file your tax as selling as a loss but if you do that often the IRS will make you prove that.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.