Who computes the freaking inflation number?

Jun 11, 2022 09:56:23 #

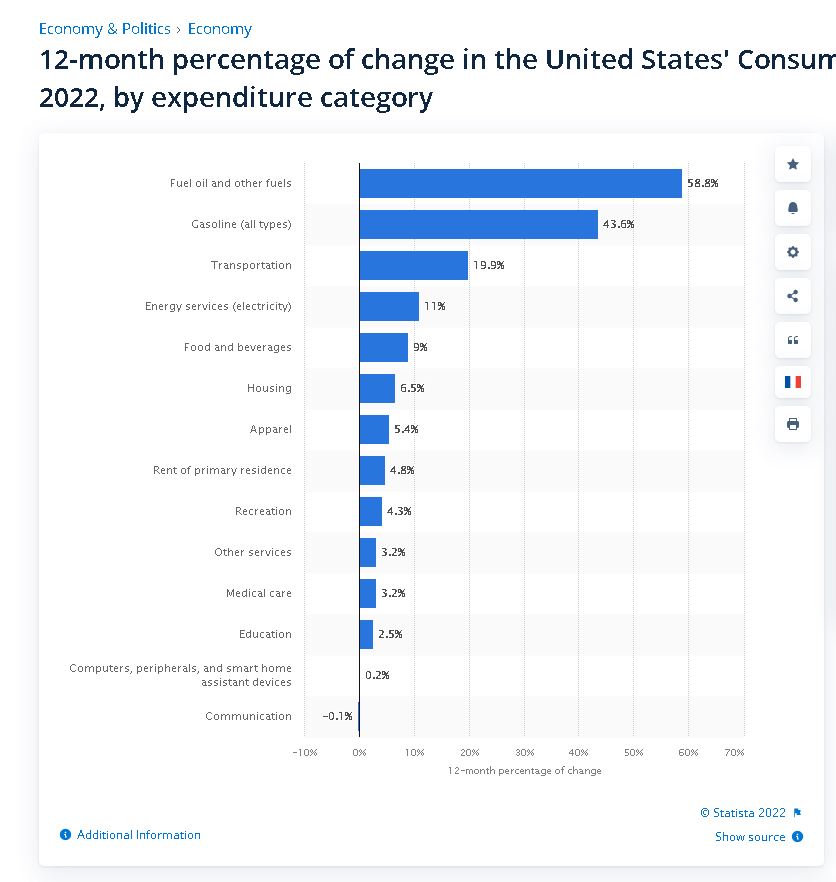

Rhetorical. I know who does, but what kind of weighting do they use and has that changed? Supposedly we're at a "rate" of 8.6 percent of annual inflation, but you and I know this is hogwash.

Everyone eats and most people drive and I know in our own family budget gasoline and food are two of the biggest items. My mortgage doesn't change (But taxes and insurance do) and most people who are renting don't get monthly increases...yet. So it's understandable that housing is lower for now. And frankly most of us don't buy clothes every day.

As for services and some of the other items that haven't risen, I think they're just lagging and right now many service companies are taking it on the chin to get market share and stay employed.

Read this detail on food and energy from the CPI and tell me they're not cooking the books even on the food number or go to the link and get the whole story:

https://www.bls.gov/news.release/cpi.nr0.htm

"Food

The food at home index rose 11.9 percent over the last 12 months, the largest 12-month increase

since the period ending April 1979. All six major grocery store food group indexes increased over

the span, with five of the six rising more than 10 percent. The index for meats, poultry, fish,

and eggs increased the most, rising 14.2 percent, with the index for eggs increasing 32.2 percent.

The remaining groups saw increases ranging from 8.2 percent (fruits and vegetables) to 12.6

percent (other food at home).

The index for food away from home rose 7.4 percent over the last year, the largest 12-month

change since the period ending November 1981. The index for full service meals rose 9.0 percent

over the last 12 months, and the index for limited service meals rose 7.3 percent over the last

year. The index for food at employee sites and schools fell 30.5 percent over the last 12 months,

reflecting widespread free lunch programs.

Energy

The energy index increased 3.9 percent in May after falling 2.7 percent in April. The gasoline

index rose 4.1 percent in May after declining in April. (Before seasonal adjustment, gasoline

prices rose 7.8 percent in May.) The index for natural gas rose 8.0 percent in May, the largest

monthly increase since October 2005. The electricity index also increased in May, rising 1.3

percent.

The energy index rose 34.6 percent over the past 12 months. The gasoline index increased 48.7

percent over the span. The index for fuel oil more than doubled, rising 106.7 percent; this

represents the largest increase in the history of the series, which dates to 1935. The index for

electricity rose 12.0 percent, the largest 12-month increase since the period ending August 2006.

The index for natural gas increased 30.2 percent over the last 12 months, the largest such

increase since the period ending July 2008. "

Everyone eats and most people drive and I know in our own family budget gasoline and food are two of the biggest items. My mortgage doesn't change (But taxes and insurance do) and most people who are renting don't get monthly increases...yet. So it's understandable that housing is lower for now. And frankly most of us don't buy clothes every day.

As for services and some of the other items that haven't risen, I think they're just lagging and right now many service companies are taking it on the chin to get market share and stay employed.

Read this detail on food and energy from the CPI and tell me they're not cooking the books even on the food number or go to the link and get the whole story:

https://www.bls.gov/news.release/cpi.nr0.htm

"Food

The food at home index rose 11.9 percent over the last 12 months, the largest 12-month increase

since the period ending April 1979. All six major grocery store food group indexes increased over

the span, with five of the six rising more than 10 percent. The index for meats, poultry, fish,

and eggs increased the most, rising 14.2 percent, with the index for eggs increasing 32.2 percent.

The remaining groups saw increases ranging from 8.2 percent (fruits and vegetables) to 12.6

percent (other food at home).

The index for food away from home rose 7.4 percent over the last year, the largest 12-month

change since the period ending November 1981. The index for full service meals rose 9.0 percent

over the last 12 months, and the index for limited service meals rose 7.3 percent over the last

year. The index for food at employee sites and schools fell 30.5 percent over the last 12 months,

reflecting widespread free lunch programs.

Energy

The energy index increased 3.9 percent in May after falling 2.7 percent in April. The gasoline

index rose 4.1 percent in May after declining in April. (Before seasonal adjustment, gasoline

prices rose 7.8 percent in May.) The index for natural gas rose 8.0 percent in May, the largest

monthly increase since October 2005. The electricity index also increased in May, rising 1.3

percent.

The energy index rose 34.6 percent over the past 12 months. The gasoline index increased 48.7

percent over the span. The index for fuel oil more than doubled, rising 106.7 percent; this

represents the largest increase in the history of the series, which dates to 1935. The index for

electricity rose 12.0 percent, the largest 12-month increase since the period ending August 2006.

The index for natural gas increased 30.2 percent over the last 12 months, the largest such

increase since the period ending July 2008. "

Jun 11, 2022 10:32:46 #

The elements of the CPI are likely weighted based on the percentages each of the elements contribute to the CPI. While fuel/energy costs have gone ballistic, how much do they contribute to the average cost of living per month?

If you spend 25% of your monthly income on food, e.g., a 9% increase (per the chart) has to be weighted against your total outlay. So the 9% increase only contributes a faction of the 25% (about 2% +/-) of the total increase.

All other increases have to be factored the same way.

Other factors include how much inflation is built in, i.e., the amount of permanent inflation due to government overspending, and the temporary conditions of cost-push and demand-pull "inflation". The last two are truly t***sitory, and thus, it's what pols and the Fed like to spout in their speeches.

If you spend 25% of your monthly income on food, e.g., a 9% increase (per the chart) has to be weighted against your total outlay. So the 9% increase only contributes a faction of the 25% (about 2% +/-) of the total increase.

All other increases have to be factored the same way.

Other factors include how much inflation is built in, i.e., the amount of permanent inflation due to government overspending, and the temporary conditions of cost-push and demand-pull "inflation". The last two are truly t***sitory, and thus, it's what pols and the Fed like to spout in their speeches.

Jun 12, 2022 11:02:02 #

Biden likes to call it Putin's price hike. But didn't the disastrous withdrawal from Afghanistan help launch Russia's war on Ukraine and Putin's inflation?

Jun 12, 2022 11:05:47 #

thom w

Loc: San Jose, CA

Fotoartist wrote:

Biden likes to call it Putin's price hike. But didn't the disastrous withdrawal from Afghanistan help launch Russia's war on Ukraine and Putin's inflation?

Explain yourself please.

Jun 12, 2022 11:09:11 #

pendennis wrote:

The elements of the CPI are likely weighted based ... (show quote)

Energy is the driving factor in my opinion. While consumers only see it directly at the gas station. They see it everywhere in the cost to manufacture/ and t***sport those goods to the checkout line.

Jun 12, 2022 11:09:40 #

thom w wrote:

Explain yourself please.

Simple. Putin would never have invaded Ukraine had he not seen the weak and feckless Biden withdrawal from Afghanistan. Hence, no "Putin price hike" and part of the inflation we are experiencing now.

Jun 12, 2022 11:10:04 #

thom w wrote:

Explain yourself please.

Biden never said that he said it heightened an existing problem

Jun 12, 2022 11:24:35 #

InfiniteISO wrote:

Rhetorical. I know who does, but what kind of weig... (show quote)

Government accounting, bureaucrats putting lipstick on a pig....the current rate of inflation is equivalent to the mid-80's and is actually running at 16.5%

Jun 12, 2022 12:36:27 #

thom w

Loc: San Jose, CA

Fotoartist wrote:

Simple. Putin would never have invaded Ukraine had he not seen the weak and feckless Biden withdrawal from Afghanistan. Hence, no "Putin price hike" and part of the inflation we are experiencing now.

Trump had planned to withdraw. How would it have been different?

Jun 12, 2022 12:38:17 #

thom w

Loc: San Jose, CA

Blaster34 wrote:

Government accounting, bureaucrats putting lipstick on a pig....the current rate of inflation is equivalent to the mid-80's and is actually running at 16.5%

Without agreeing, or disagreeing, with you, where do your numbers come from?

Jun 12, 2022 14:44:53 #

DennyT wrote:

Energy is the driving factor in my opinion. While consumers only see it directly at the gas station. They see it everywhere in the cost to manufacture/ and t***sport those goods to the checkout line.

Yes. It's the driving factor in every element of the supply chain. And there's also the "estimation factor" when attempting to explain cost increases. When a company sets prices for their goods, they will always overestimate the increase in cost. When cost analysts get news that the new fuel price increased by X%, they will factor in X+%, because no one wants to be blamed if the ROI or profit forecast comes in off the estimate. This works both ways, although there is more tolerance for missing the forecast on the plus side.

For years, I managed the costing data base for a major auto manufacturer. And the cost analysts took p***e in hitting the numbers on the screws. Woe be to the analyst who missed his part of the forecast.

Jun 12, 2022 15:38:38 #

thom w wrote:

Without agreeing, or disagreeing, with you, where do your numbers come from?

One commentor on CNBC made that correlation...Forbes, Business Insider is where I usually go for financial analysis. But in general terms, methodological shifts in government reporting have depressed reported inflation, moving the concept of the CPI away from being a measure of the cost of living needed to maintain a constant standard of living.

Unbiased private-sector efforts to calculate the real rate of inflation have yielded a rate of around 7% to 13% per year, depending on the locale, many multiples of the official rate of around 1% per year....

The U.S. Bureau of Economic Analysis (BEA) will release the May PCE reading on June 30. CPI and PCE measure inflation based on pricing a basket of goods......The two baskets are different, and the formulas used to calculate each measure are not the same. The CPI calculation is based on a survey of goods consumers buy, whereas the PCE is based on a survey of goods businesses sell.

One final comment and a major issue, core inflation strips out only food and energy prices, because they can be pretty volatile due to environmental issues or geopolitics, Core CPI inflation excludes energy, food, alcoholic beverages and tobacco....when all is said and done, the government is the last place I would look for true financial analysis. Remember Janet Yellen, "inflation is just t***sitory" and "I was wrong"....America is not getting the real story on inflation, government soft peddles it. I would think closer to 13%.

I lived through the Carter inflation, had a 14.5% mortgage....and this is becoming far worse with energy and food costs soaring above that period. Fed is going to have to take severe measures to curtail this mess and that equals recession which usually cures inflation....Cheers Thom

Jun 12, 2022 18:41:00 #

pendennis wrote:

The elements of the CPI are likely weighted based ... (show quote)

One of the factors is this: if you are used to eating steak, they figure you should switch to bologna. That way, prices aren't going up as much as they really are. The substitution game is what hides true inflation.

But the main economic policy driving inflation is quantitative tightening, which is what has to happen after years of quantitative easing. The Fed can't keep supporting US deficit spending and has to back off. Result: house of cards must collapse.

Jun 12, 2022 18:57:52 #

jcboy3 wrote:

One of the factors is this: if you are used to eating steak, they figure you should switch to bologna. That way, prices aren't going up as much as they really are. The substitution game is what hides true inflation.

But the main economic policy driving inflation is quantitative tightening, which is what has to happen after years of quantitative easing. The Fed can't keep supporting US deficit spending and has to back off. Result: house of cards must collapse.

But the main economic policy driving inflation is quantitative tightening, which is what has to happen after years of quantitative easing. The Fed can't keep supporting US deficit spending and has to back off. Result: house of cards must collapse.

....and it could get potentially ugly, really ugly.

....and it could get potentially ugly, really ugly.Jun 12, 2022 19:38:54 #

Blaster34 wrote:

....and it could get potentially ugly, really ugly.

....and it could get potentially ugly, really ugly.

....and it could get potentially ugly, really ugly.

....and it could get potentially ugly, really ugly.Market valuation norms indicate an expected loss of 60-70%, although correction overshoot could bring those losses to 75% or more. The Fed policies of extremely low interest and quantitative easing have driven investments from the bond market, leaving real estate and the stock market. Both are in bubble territory. Increased interest rates will temporarily collapse the bond market further, along with the stock market and the real estate market. Valuations are worse than in 2000. I'm not sure ugly is sufficient. At some point, living may become unaffordable for a large number of people. The longer the housing market is an investment market, the worse that may become as well.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.