As Wealth Tax Debate Heats Up, What Does it Mean to Invest in America?

Nov 11, 2019 13:55:33 #

Tex-s wrote:

Just take Apple as an example. In 2007 Americans ... (show quote)

Great post, I wholeheartedly agree, wealth envy is not productive, I totally am against ill begotten gains through associations with our government that are less than proper and I am very dissatisfied with much of what I think that I see on Wall Street, but folks like Steve Jobs and Bezos are what has made this country great. I have never worried about equity of income but have always been concerned about equity of opportunity.

Bernie and Warren will confiscate much of the capital that fuels and grows our economy but somehow the democrats never consider the effect of such wealth confiscation. As I have said time and time again here, Bezos does not have $100 billion in the bank or laying on the kitchen table, it is invested in capital both physical and human that makes our economy work.

Nov 11, 2019 14:20:47 #

thom w

Loc: San Jose, CA

letmedance wrote:

??

It’s a tax that is paid every year, on the same piece of property. The party I responded to was trying to make a case that once you have paid tax on something, you should never be taxed on it again.

Nov 11, 2019 14:32:33 #

thom w wrote:

It’s a tax that is paid every year, on the same piece of property. The party I responded to was trying to make a case that once you have paid tax on something, you should never be taxed on it again.

Yes Thom,

I had a response and replaced it with ??, as I realized that I might be mistaken about your words. Property taxes support or States and Cities which provide the services we depend upon. Things like Schools, Law Enforcement, Fire fighters, and many more.

Did you know that Ca, and possibly other states charge a tax on business inventory?

Nov 11, 2019 15:19:37 #

Blurryeyed wrote:

Such a stupid article written by someone who could not possibly have more than a 3rd grade education. The taxation claims the author makes are lies and nothing better can be said for them, the author of this article is lying to you yet here you are reposting it, it only goes to show that you are indeed in need of an education yourself.

Its stupid because its from politicususa.

Nov 11, 2019 15:41:27 #

[quote=Kraken]Elizabeth Warren’s wealth tax proposal has certainly sparked debates not just about basn the very economy and infrastructure that made the success of millionaire’s possible....

"Directing resources through public policy not to the wealthy but to the worker contributes more powerfully to the health of the economy and overall society."

Oh yes and Cracken is real proof of that as he can spend 25 hours a day on this site shoveling his Politipussy bilge water. You contribute nothing to society but are a malignant cancer.

"Directing resources through public policy not to the wealthy but to the worker contributes more powerfully to the health of the economy and overall society."

Oh yes and Cracken is real proof of that as he can spend 25 hours a day on this site shoveling his Politipussy bilge water. You contribute nothing to society but are a malignant cancer.

Nov 11, 2019 16:12:31 #

Blurryeyed wrote:

Such a stupid article written by someone who could not possibly have more than a 3rd grade education. The taxation claims the author makes are lies and nothing better can be said for them, the author of this article is lying to you yet here you are reposting it, it only goes to show that you are indeed in need of an education yourself.

A couple of comments.....

>the f*****t progressives like Warren are well aware they can fool most the country, and all the progressives, by dividing the country and attacking our meritocracy and wealth. Example is her lame brained plan to tax wealth....the simple t***h is that it not only lacks basic math accuracy, it’s useless!

The U.S, has about 585 Billionaires with a total Combined Net Worth of about $3.096T.

Think about it, folks.....let’s even call it $3.1 trillion. You could confiscate 100% of their wealth and not even cover ONE FULL YEAR OF HER INCREDIBLY D******E, JUVENILE, AND SOCIALIST Medicare for all s**m!

In fact, the 100% confiscation would cover only about 8-9 months of the current US Federal spending

WITHOUT the additional Warren s**m.

>see this article from Steven Hayward:

THIN LIZZIE’S WEDGE

I’m starting to wonder whether Elizabeth Warren is another Karl Rove/Steve Bannon dirty trick—a plant inside the Democratic Party with the perfect appeal to make the party sign up for the biggest political suicide note since the Labour Party decided to run on unilateral disarmament against Margaret Thatcher in 1983. (Labour lost in a historic landslide.)

Warren’s Medicare-for-All will depend apparently on a 6 percent wealth tax on the super-rich, up from a previously proposed 3 percent. (Funny how the tax rate is rising already.) Here’s a riddle. Let’s just take Jeff Bezos and Bill Gates, each worth something like $100 billion in round numbers. I am continually surprised by the number of people who think that Bezos, Gates, Buffett, etc., all have $100 billion in cash in a bank savings account or something—or even stacks of $100 bills in a vault somewhere. The fact that these wealth figures are the capitalized market value of the immense asset base (tangible and intangible) on paper (and only at the margin) is lost on everyone.

So let’s just take a hypothetical annual 3% wealth tax and run it out. Gates, Bezos, Buffett, et al. will have to sell $3 billion worth of their stock holdings—each year—to send their wealth tax check to the IRS.

Question: Just who is going to buy that much stock every year?

And what would the effect of the many forced liquidations have on stock values, not to mention credit markets if Bezos decided to borrow the money every year (and, incidentally, wipe out any income tax liability for the year—heh)?

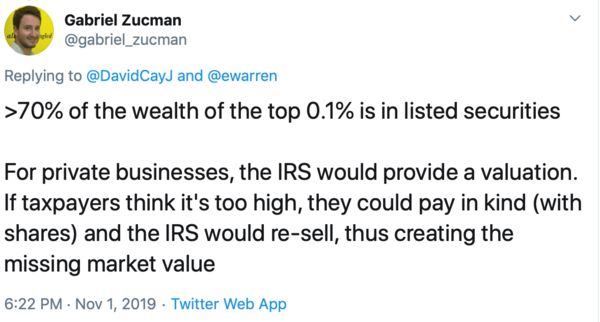

Now let’s move down the food chain a bit to the many large fortunes that are privately owned, rather than expressed in the market value of a publicly-traded company, such as people in real estate, or in any kind of business with a lot of fixed assets not easily liquidated (such as someone who owns a lot of fast food franchises). How would these assets be valued and taxed? The socialist economist advising Warren on her scheme, Gabriel Zucman, offers this suggestion:

[see first pic, below]

So—the IRS is going to get into the private placement business. Great. I’ll look forward to this, and go very long on popcorn futures. Question: And who is the IRS going to sell these “shares” to? I’m just sure there will be a long line of investors wanting to buy minority shares in a closely-held businesses, which will have to be done at a huge discount to true market value in any case.

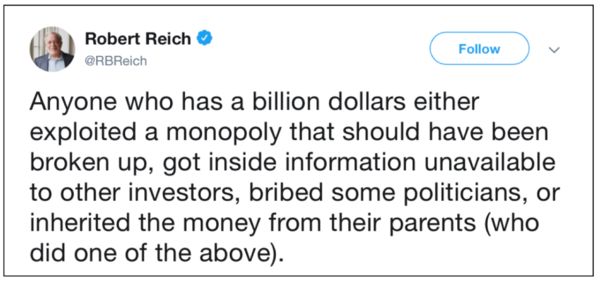

The detachment from reality here is breathtaking. But reality may not be the main object of this whole exercise. What we’re really seeing in action is “punitive liberalism.” I refer back to a suite of tweets I shared some months ago:

[see second pic, below]

Question: I guess it is true that billionaire Oprah Winfrey exploited a monopoly over herself, but I’m not sure just how you’d “break up” Oprah. And in any case I can’t discern any way in which Oprah competed unfairly against, say, Sally Jessie Raphael. Perhaps Prof. Reich can explain it in his next $50,000 lecture.

I like this chart that one of the wealth taxers has offered, showing what the effect would have been had the proposed wealth tax been in place starting back in 1982:

The economic illiteracy of this is staggering, as it means the enterprise value of each of the companies behind these figures would be much smaller, and/or the cost of capital (a key driver of business investment) would be much higher.

Incidentally, most European nations that attempted a wealth tax have abandoned it. But the ones that supposedly still have it fall out like this:

You’ll notice the tax rates are all substantially below what Warren is proposing. Note also that most of these European wealth tax schemes subtract debt from net worth, as they should. If adopted here, this would provide a huge incentive for rich people to load up on debt to escape or minimize the tax, and since interest is deductible against income taxes, guess what? Warren’s proposal is going to be a full employment act for tax lawyers and accountants. The evasion and financial engineering schemes are going to be massive. My hunch is that the proposed wealth tax won’t bing in even half as much as Warren estimates. Good times!

Nov 11, 2019 19:17:11 #

Warren says I am for the poor people and the middle class. If you believe that then you need to see a shrink ASAP. One has to just look at the ugly smirk on her face as she spews out the crap from her bottom cheeks. Look how quickly she turns to change the subject and to degrade the person asking the question. Liz is only out for Liz. She is 20 times more crooked than Trump. She has lied and lied and lied again all thru her career for her own betterment. If you don't believe it then I suggest looking up the facts.

Nov 11, 2019 19:28:32 #

incognito wrote:

Warren says I am for the poor people and the middl... (show quote)

She’s a millionaire, like most of the democrat wannabes, whining and attacking billionaires.

This is a SNL skit already written!

Nov 11, 2019 19:40:36 #

Kraken wrote:

Elizabeth Warren’s wealth tax proposal has certain... (show quote)

anyone that supports a wealth tax is a jerk. Everyone should be taxed at the same rate; billionaires, poor, corporations. That is e******y. Down with Warren. Down with Bernie, etc., etc. Down with socialism (the economic system that always ends in ruin).

Nov 12, 2019 09:19:18 #

Essentially, Senator Warren v**e seeks to gain the White House. Like any politician, she will say or do almost anything to get elected or re-elected. In her case, she proposes radical change in the economic system. Under her Accountable Capitalism Act, Senator Warren proposes this change:

"Borrowing from the successful approach in Germany and other developed economies, a United States corporation must ensure that no fewer than 40% of its directors are selected by the corporation’s employees."

[found at: https://www.warren.senate.gov/imo/media/doc/Accountable%20Capitalism%20Act%20One-Pager.pdf]

This change resembles the movement known as Syndicalism. Under it, workers via labor unions own the means of production and distribution -- goodbye capitalism.

The thinker Karl Marx proposed this movement as a central element of c*******m.

We may suppose that this change opens the slippery slope to more and more worker control over the performance of the economy via this proposed law. After all, the law could later dictate 45 percent and then 50 percent and so forth in the makeup of the corporate directors. Enough control would effectively equate to ownership.

This momentous change assumes that workers or their representatives have the wherewithal to put their minds around business principles and successful business operations, instead of merely self-interest.

The power of corporations would t***sform to animate a social mechanism. The relations of production would reflect not an economic outcome so much as a social one, stemming from a change in central direction.

Marx predicted that socialism would bridge capitalism to c*******m. Does Senator Warren understand this historical t***sformation? Does she unwittingly act as the early vanguard of c*******m by her proposal to alter the purpose of corporations?

You will find the other plans of Senator Warren at:

https://elizabethwarren.com/plans

"Borrowing from the successful approach in Germany and other developed economies, a United States corporation must ensure that no fewer than 40% of its directors are selected by the corporation’s employees."

[found at: https://www.warren.senate.gov/imo/media/doc/Accountable%20Capitalism%20Act%20One-Pager.pdf]

This change resembles the movement known as Syndicalism. Under it, workers via labor unions own the means of production and distribution -- goodbye capitalism.

The thinker Karl Marx proposed this movement as a central element of c*******m.

We may suppose that this change opens the slippery slope to more and more worker control over the performance of the economy via this proposed law. After all, the law could later dictate 45 percent and then 50 percent and so forth in the makeup of the corporate directors. Enough control would effectively equate to ownership.

This momentous change assumes that workers or their representatives have the wherewithal to put their minds around business principles and successful business operations, instead of merely self-interest.

The power of corporations would t***sform to animate a social mechanism. The relations of production would reflect not an economic outcome so much as a social one, stemming from a change in central direction.

Marx predicted that socialism would bridge capitalism to c*******m. Does Senator Warren understand this historical t***sformation? Does she unwittingly act as the early vanguard of c*******m by her proposal to alter the purpose of corporations?

You will find the other plans of Senator Warren at:

https://elizabethwarren.com/plans

Blurryeyed wrote:

You do realize that we will all be taxed and many ... (show quote)

Nov 12, 2019 09:28:10 #

thom w

Loc: San Jose, CA

letmedance wrote:

Yes Thom,

I had a response and replaced it with ??, as I realized that I might be mistaken about your words. Property taxes support or States and Cities which provide the services we depend upon. Things like Schools, Law Enforcement, Fire fighters, and many more.

Did you know that Ca, and possibly other states charge a tax on business inventory?

I had a response and replaced it with ??, as I realized that I might be mistaken about your words. Property taxes support or States and Cities which provide the services we depend upon. Things like Schools, Law Enforcement, Fire fighters, and many more.

Did you know that Ca, and possibly other states charge a tax on business inventory?

Does anyone not know that? It's as of a certain day. it's amazing how much inventory is on a truck in Nevada on that day.

Nov 12, 2019 11:43:01 #

Elaine2025

Loc: Seattle, Wa

Kraken wrote:

Elizabeth Warren’s wealth tax proposal has certain... (show quote)

Post number three today from whacked out politicususa. What a surprise Krackhead. Send it to your people in kanuckistan, they believe anything.

Nov 12, 2019 11:46:10 #

Elaine2025 wrote:

Post number three today from whacked out politicususa. What a surprise Krackhead. Send it to your people in kanuckistan, they believe anything.

You never get anything right, take a look at the date, it's yesterday's date.

Nov 12, 2019 11:50:50 #

Elaine2025

Loc: Seattle, Wa

Kraken wrote:

You never get anything right, take a look at the date, it's yesterday's date.

Still an ignorant post form your favorite ignorant paper little kanuck from kanuckistan.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.