Why are the Feds Subsidizing the Ivy League?

Apr 12, 2017 20:51:46 #

An interesting article that should outrage us all, especially the libs, why are we giving these elitists all this taxpayer money. Judging by the compensation of their administration, they should also be paying corporate taxes, it is only by a far stretch of the imagination that they can be considered a non-profit institution.

Subsidizing the Ivy League

By Adam Andrzejewski

April 12, 2017

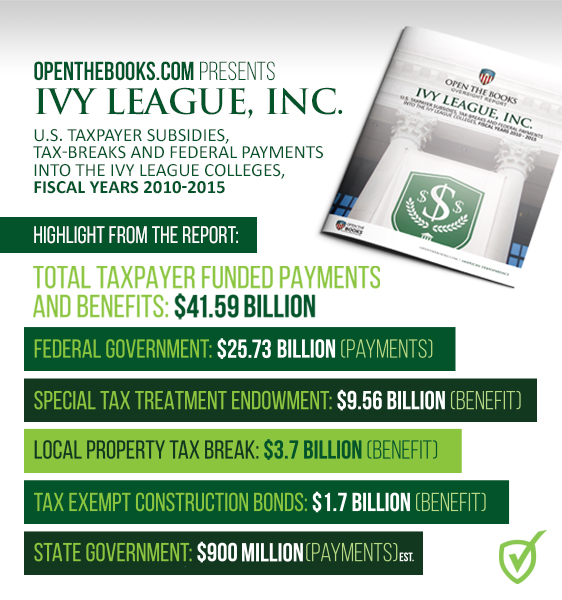

During a six-year period (2010â2015), the eight colleges of the Ivy League â Brown, Columbia, Cornell, Dartmouth, Harvard, Princeton, Yale,  and the University of Pennsylvania â received nearly $42 billion in U.S. taxpayer subsidies, tax-breaks, and federal payment of contracts, grants, and direct payments.

These findings were published by OpenTheBooks.com in our recent oversight report: Ivy League, Inc. Here are the key findings from the investigation

Ivy League payments and entitlements cost taxpayers $41.59 billion over a six-year period (FY2010âFY2015). This is equivalent to $120,000 in government monies, subsidies, and special tax treatment per undergraduate student, or $6.93 billion per year.

The Ivy League was the recipient of $25.73 billion worth of federal payments during this period: contracts ($1.37Â billion), grants ($23.9 billion) and direct payments â student assistance ($460 million).

In monetary terms, the âgovernment contractingâ business of the Ivy League ($25.27 billion in federal contracts and grants) exceeded their educational mission ($22 billion in student tuition) FY2010âFY2015.

The eight colleges of the Ivy League received, on average, more money ($4.31 billion) annually from the federal government than sixteen states.Â

The Ivy League endowment funds (2015) exceeded $119 billion, which is equivalent to nearly $2 million per undergraduate student.

As a non-profit, educational institution, the Ivy League pays no tax on investment gains. Between FY2011âFY2015, the Ivy League schools received a $9.6 billion tax break on the $27.3 billion growth of their endowment funds. In FY2014, the tax-free subsidy on endowment gains amounted to $3.4 billion, or nearly $60,000 per student.

With continued gifts at present rates, the $119 billion endowment fund provides free tuition to the entire student body in perpetuity. Without new gifts, the endowment is equivalent to a full-ride scholarship for all Ivy League undergraduate students for 51 years, or until 2068.

In FY2014, the balance sheet for all Ivy League colleges showed $194,332,115,120 in accumulated gross assets. This is equivalent to $3.35 million per undergraduate student.

The Ivy League employs 47 administrators who each earn more than $1 million per year. Two executives each earned $20 million between 2010â2014. Ivy League employees earned $62 billion in compensation.

In a five-year period (2010â2014) the Ivy League spent $17.8 million on lobbying, which included issues mostly related to their endowment, federal contracting, immigration, and student aid.

Subsidizing the Ivy League

By Adam Andrzejewski

April 12, 2017

During a six-year period (2010â2015), the eight colleges of the Ivy League â Brown, Columbia, Cornell, Dartmouth, Harvard, Princeton, Yale,  and the University of Pennsylvania â received nearly $42 billion in U.S. taxpayer subsidies, tax-breaks, and federal payment of contracts, grants, and direct payments.

These findings were published by OpenTheBooks.com in our recent oversight report: Ivy League, Inc. Here are the key findings from the investigation

Ivy League payments and entitlements cost taxpayers $41.59 billion over a six-year period (FY2010âFY2015). This is equivalent to $120,000 in government monies, subsidies, and special tax treatment per undergraduate student, or $6.93 billion per year.

The Ivy League was the recipient of $25.73 billion worth of federal payments during this period: contracts ($1.37Â billion), grants ($23.9 billion) and direct payments â student assistance ($460 million).

In monetary terms, the âgovernment contractingâ business of the Ivy League ($25.27 billion in federal contracts and grants) exceeded their educational mission ($22 billion in student tuition) FY2010âFY2015.

The eight colleges of the Ivy League received, on average, more money ($4.31 billion) annually from the federal government than sixteen states.Â

The Ivy League endowment funds (2015) exceeded $119 billion, which is equivalent to nearly $2 million per undergraduate student.

As a non-profit, educational institution, the Ivy League pays no tax on investment gains. Between FY2011âFY2015, the Ivy League schools received a $9.6 billion tax break on the $27.3 billion growth of their endowment funds. In FY2014, the tax-free subsidy on endowment gains amounted to $3.4 billion, or nearly $60,000 per student.

With continued gifts at present rates, the $119 billion endowment fund provides free tuition to the entire student body in perpetuity. Without new gifts, the endowment is equivalent to a full-ride scholarship for all Ivy League undergraduate students for 51 years, or until 2068.

In FY2014, the balance sheet for all Ivy League colleges showed $194,332,115,120 in accumulated gross assets. This is equivalent to $3.35 million per undergraduate student.

The Ivy League employs 47 administrators who each earn more than $1 million per year. Two executives each earned $20 million between 2010â2014. Ivy League employees earned $62 billion in compensation.

In a five-year period (2010â2014) the Ivy League spent $17.8 million on lobbying, which included issues mostly related to their endowment, federal contracting, immigration, and student aid.

Apr 13, 2017 06:51:15 #

Wow, someone must have been rejected by Harvard! This article lumps together grants, contracts, tax deductions, etc. It is brainwashing Fox nonsense. How? OK: First: ANY non-profit does not pay income tax and generally does not pay local property taxes. Like many non-profits, they generate a lot of income that generates a lot of taxes for local, state, and federal governments. Second: Grants: Ivy League schools are not excluded from applying for research and other grants from the federal government. And guess what - these schools that often do top-quality research - are pretty competitive when it comes to applying for research grants. Third: contracts - sometimes the government needs things done, and contracts services from these universities. An example I can think of is a university-owned research nuclear reactor used to generate radioactive isotopes for research, medical diagnosis, and medical treatment. The government is a customer. Fourth: not surprisingly, many students that attend these universities are eligible for government grants and scholarships.

We have a large non-profit in my community that is largely supported by the government. Outrageous! Oh - it's a hospital, which in Florida more than half of the patients are on Medicare or Medicaid. Maybe that's not such a bad thing...

We have a large non-profit in my community that is largely supported by the government. Outrageous! Oh - it's a hospital, which in Florida more than half of the patients are on Medicare or Medicaid. Maybe that's not such a bad thing...

Apr 13, 2017 07:33:11 #

sb wrote:

Wow, someone must have been rejected by Harvard! ... (show quote)

You may have a point when it comes to government contracts, research grants, and tax-deductions. However, it is absolutely true that Ivy League Schools are just bursting with cash profits, and they could give a free education for the next 51 years of graduating classes. This is partially a result of so many rich people donating money to them, and the Federal Government subsidizing every student who cannot afford their greater than $50 Thousand Dollar a year tuition. If not for these government subsidies, they would be charging magnitudes less for tuition. Perhaps there is something wrong with the tax system or with the definition of "non-profit." I question whether they generate a lot of income for local and State taxes, because they generally do not produce any products that are taxable.

Apr 13, 2017 08:55:17 #

Apr 13, 2017 18:58:19 #

sb wrote:

Wow, someone must have been rejected by Harvard! ... (show quote)

They receive more in federal money than they do in tuition, personally I am suspicious of those federal contracts, I have witnessed their symposiums where they help to write federal policy, why are we paying for them to do that when we have the federal bureaucracy, what are we paying the bureaucrats for? Why do we need to turn to folks like Gruber and pay him millions in consultation fees to create federal policy? I am pretty sure that state schools are not receiving similar sums of money. If they are paying administrators $10,000,000 in annual compensation there is no justifiable reason for them to have tax exempt status, maybe you can help me understand the rational used for an income producing private organization to have tax exempt status, I would also include hospitals in this category as well.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.