Tax Deduction

Oct 8, 2016 09:22:25 #

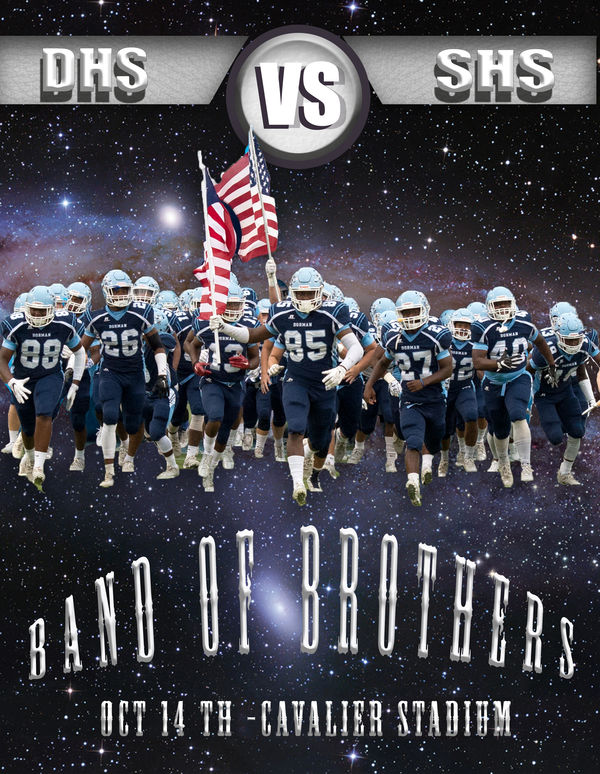

When, not if, the IRS ask me how in this world can I justify taking the cost of Astronomy Gear as a business deduction. Well, I will print out this picture! Hope they buy it!

Oct 8, 2016 09:46:24 #

Oct 8, 2016 10:23:53 #

Oct 8, 2016 11:45:06 #

Well, the only time you have to justify your deductions is in the case of an audit.

Or, as I like to say, Anything's legal until you get caught.

Or, as I like to say, Anything's legal until you get caught.

Oct 8, 2016 12:44:30 #

SonnyE wrote:

Or, as I like to say, Anything's legal until you get caught.

The answer, from someone who was audited in 2000 when self employed, is not quite that simple.

IRS regulations allow small business to enjoy a "safe harbor" of 5 years of losses before a profit has to be shown. During that time, business expenses can be deducted on Schedule C as long as you do not go crazy. You can deduct a portion of your camera gear purchases over a multi year depreciation, costs for trips if exclusively for the business (don't go to Europe and deduct the entire cost of the trip as a "business expense," that could cause an audit flag. Anything exaggerated can raise a flag.

Also, do not bother with a home office deduction, unless you have a full time photo studio in your home. Deducting for home office before my business showed a profit is what got me audited in the first place. And, if you ever sell your home, you have to give back the $$ you deducted for the H.O. from the cost of your home sale.

You can, however, claim a mileage deduction for the percentage of your travel that is business related. Or the cost of your internet connection that is business related. Lots of opportunites.

Oct 8, 2016 14:58:08 #

rgrenaderphoto wrote:

The answer, from someone who was audited in 2000 w... (show quote)

_________________________

You are totally correct. I actually posted that a little "tongue in cheek".

Oct 10, 2016 19:52:48 #

nikonshooter wrote:

_________________________

You are totally correct. I actually posted that a little "tongue in cheek".

You are totally correct. I actually posted that a little "tongue in cheek".

Me too.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.