Bend over sheeple!

Nov 10, 2021 08:37:26 #

Nov 10, 2021 08:58:43 #

How else are they going to pay for all the stuff the government is proposing"

Nov 10, 2021 09:15:15 #

idaholover wrote:

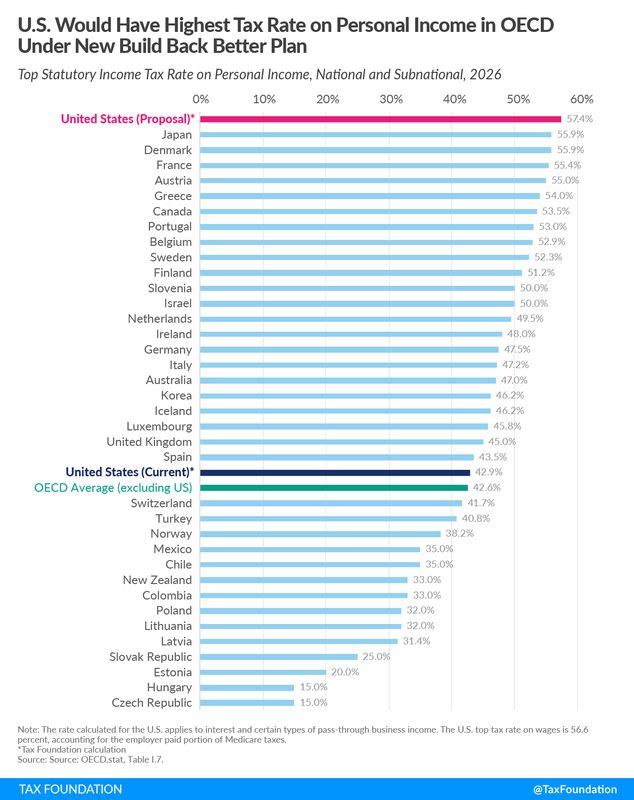

https://taxfoundation.org/democrats-top-income-tax-rate/

True but those rates are high earners making more than $10 million per year and counts in the surcharge on people making over $25M

So let’s not scare people that is everyone.

It’s not.

Nov 10, 2021 09:27:39 #

CORRECTION: "free stuff." AKA tax giveaways. A design of creeping socialism with bigger government to process federal handouts. With the fiscal impact to adopt a budget with a deficit requiring loans to fund this budget. Deficits covered by loans add to the national debt.

pdsdville wrote:

How else are they going to pay for all the stuff the government is proposing"

Nov 10, 2021 09:31:04 #

idaholover wrote:

https://taxfoundation.org/democrats-top-income-tax-rate/

Shame on you, this is deliberately misleading; the top rate applies to a relative handful of top earners. Fake news

Nov 10, 2021 09:50:51 #

DennyT wrote:

True but those rates are high earners making more than $10 million per year and counts in the surcharge on people making over $25M

So let’s not scare people that is everyone.

It’s not.

So let’s not scare people that is everyone.

It’s not.

True. But those people getting hit with the exorbitant tax rate are the ones who create jobs for middle income and poor people. Disincentivize them and the ripple effect in the economy will hurt everyone under them.

Nov 10, 2021 11:06:01 #

DennyT wrote:

True but those rates are high earners making more than $10 million per year and counts in the surcharge on people making over $25M

So let’s not scare people that is everyone.

It’s not.

So let’s not scare people that is everyone.

It’s not.

It is when the cost of goods goes skyrocketing

Nov 10, 2021 11:10:20 #

idaholover wrote:

It is when the cost of goods goes skyrocketing

Different subject. You started the post stay on target.

Nov 10, 2021 11:19:12 #

Fotoartist wrote:

True. But those people getting hit with the exorbitant tax rate are the ones who create jobs for middle income and poor people. Disincentivize them and the ripple effect in the economy will hurt everyone under them.

Baloney

Nov 10, 2021 11:31:54 #

phlash46 wrote:

Baloney

Pay him no mind, Fotofartest can make up stuff faster than

Grimm's fairy tales. That's why he never posts a link with his BS.

Nov 10, 2021 13:51:29 #

DennyT wrote:

Different subject. You started the post stay on target.

You don’t get much do you?

Nov 11, 2021 10:06:28 #

idaholover wrote:

It is when the cost of goods goes skyrocketing

and that has exactly what to do with tax rates on the top earners?

Nov 11, 2021 10:14:04 #

DennyT wrote:

True but those rates are high earners making more than $10 million per year and counts in the surcharge on people making over $25M

So let’s not scare people that is everyone.

It’s not.

So let’s not scare people that is everyone.

It’s not.

Oh, but it is everybody. First, they can't generate enough revenue just from the rich because they always find a way to shelter some income from taxes. And, second and more important when you raise corporate taxes, or the taxes on CEOs they just pass the costs on to consumers. That means although lower and middle class citizens may not pay ore in taxes they will pay more in the cost of goods and services as a direct result of the proposed tax increase.

We are already seeing the resulting inflation and the tax increase hasn't even happened yet.

Nov 11, 2021 10:15:57 #

btbg wrote:

Oh, but it is everybody. First, they can't generat... (show quote)

If you are trying to make it as an economist don't quit your day job. Your "analysis" is wrong on so many levels I don't know where to begin.

Nov 11, 2021 10:27:55 #

phlash46 wrote:

and that has exactly what to do with tax rates on the top earners?

Highest corporate rates in the world gets passed on. Don't quit your day job.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.